Economy

Curtis Shelton | October 11, 2019

Attack reminds us of Oklahoma's volatile revenue sources

Curtis Shelton

The recent attack on Saudi Arabia and Iran’s oil industry sent crude prices soaring. The tightening of the supply is set to increase prices for some time, with many Oklahoma companies likely to benefit. However, while this surprise attack may benefit Oklahoma in the short term, it serves to remind us of the state’s reliance on the energy industry and how its volatility can affect the state’s budget.

The current international incident may be to the state’s benefit, but it was not long ago that international forces caused major financial stress for Oklahoma. In late 2015 and throughout 2016 the oil market was flooded with excess supply as OPEC refused to cut production. The result was a massive drop in the price of oil, which led to a statewide recession and produced a budget shortfall for state government.

Commodities, such as oil and gas, have long been some of the most volatile markets, often resulting in unstable state revenue for states that rely heavily on these commodities. There is no doubt that when it comes to Oklahoma’s state budget, severance taxes have been considerably more volatile than any other revenue source.

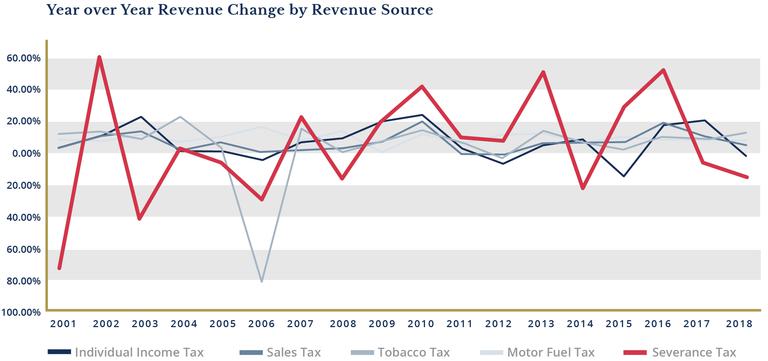

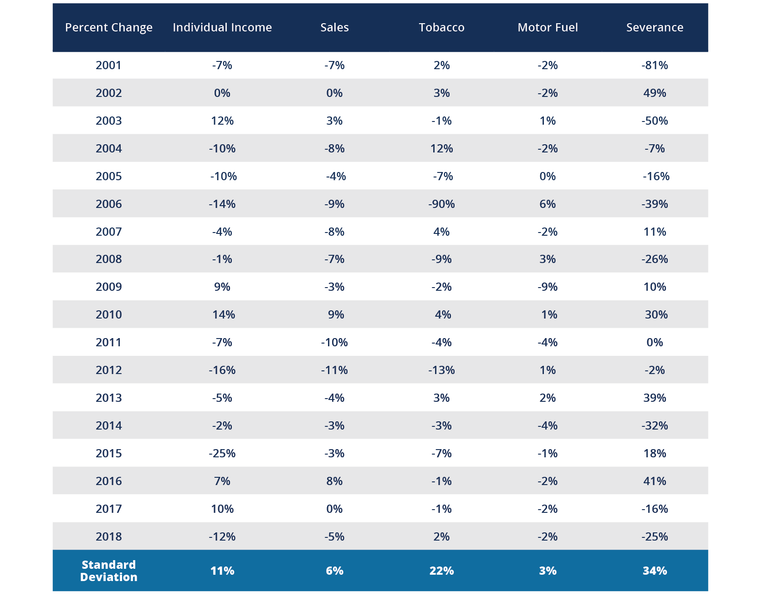

The chart above shows the difference in volatility between severance taxes and the four other major revenue sources for Oklahoma. Since 2001 the standard deviation (a metric used to measure volatility) for severance taxes was 34 percent; the next closest was tobacco taxes at 22 percent. The table below shows all five major revenue sources.

Oklahoma’s strong reliance on commodities, particularly the oil and gas industry, leaves the state vulnerable to global forces over which it has no control. This volatility makes budgeting decisions difficult and often leads to a bigger government. Whenever state revenues take a drastic fall there are cries to raise taxes (as happened in 2017) rather than to keep government contained as the economy recovers. During a large surplus there is a rush to spend every dime, creating an unsustainably large budget when the economy returns to a stable growth rate.

If Oklahoma wants to reduce its reliance on volatile revenue sources it must attract new industry in different markets. However, relying on subsidies to do this would be the wrong approach. Instead, creating a more competitive tax environment so that businesses find Oklahoma more attractive would produce better results. Look no further than Texas for proof.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.