Budget & Tax

Curtis Shelton | August 8, 2017

How does Oklahoma’s tax burden compare to other states?

Curtis Shelton

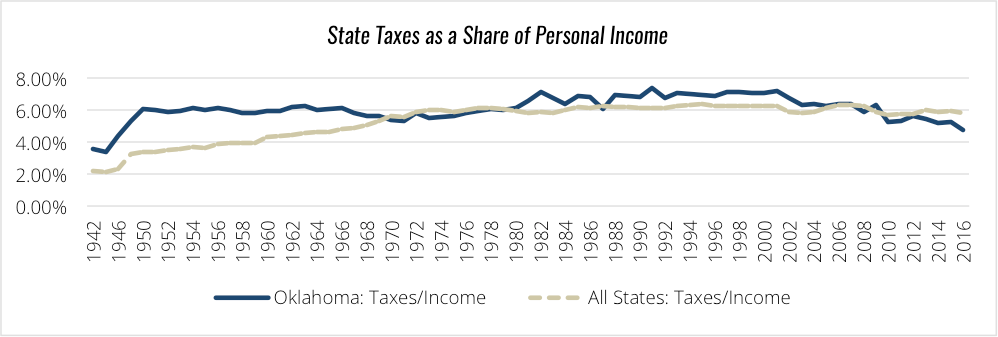

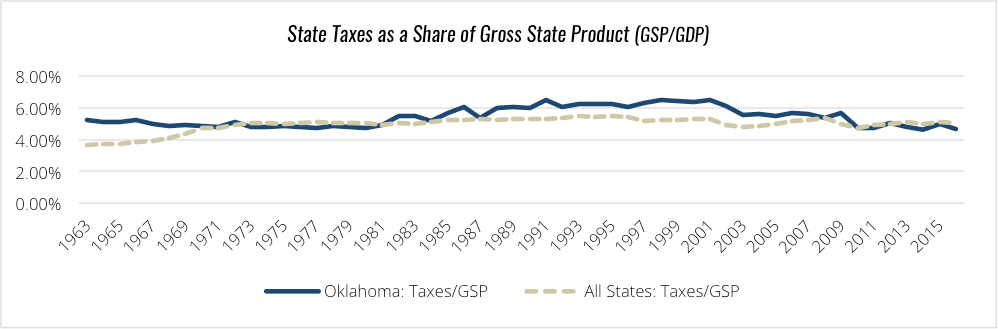

While many believe Oklahoma is a low-tax state, research by former Tax Foundation economist William Freeland questions this assumption. His study shows Oklahoma’s tax burden both as a share of state income and gross state product (GSP) and compares Oklahoma to the averages in all states.

Freeland’s research looks back to 1942 when comparing taxes as a share of state income and finds that for 68 out of those 88 years Oklahoma had a higher tax burden then the national average. When comparing GSP from 1963 forward, a similar trend is found. Oklahoma had higher taxes as a share of GSP for 40 out of the 53 years that were analyzed. During the 1990s both indexes show Oklahoma above the national average, but in more recent years Oklahoma has begun to trend downwards. Oklahoma has been under the average in both indices since 2010.

The tax burden is an important factor when it comes to economic growth. These data provide an opportunity to consider how Oklahoma’s economy has fared with high or low tax burdens. Oklahomans’ income grew by 8.02% on average in the years that the share of taxes compared to income levels was lower than that of the rest of the states. The growth rate was lower during the years in which the tax burden was higher; in those years income grew by 5.84%. The same disparity is found with GSP, which grew on average by 10.06% with a lower tax burden and 5.69% when the burden was higher than the national average.

The data show that Oklahoma is not quite the low tax state some assume it is. They also reveal that Oklahoma’s economy has grown more in years where it had a lower tax burden relative to other states. While this one factor alone does not guarantee growth, it is an important one to consider as Oklahoma continues to deal with a lagging economy due to the decline in the price of oil.

Sources: https://www.census.gov/govs/statetax/historical_data.html

https://www.bea.gov/regional/downloadzip.cfm

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.