Budget & Tax

Curtis Shelton | September 20, 2021

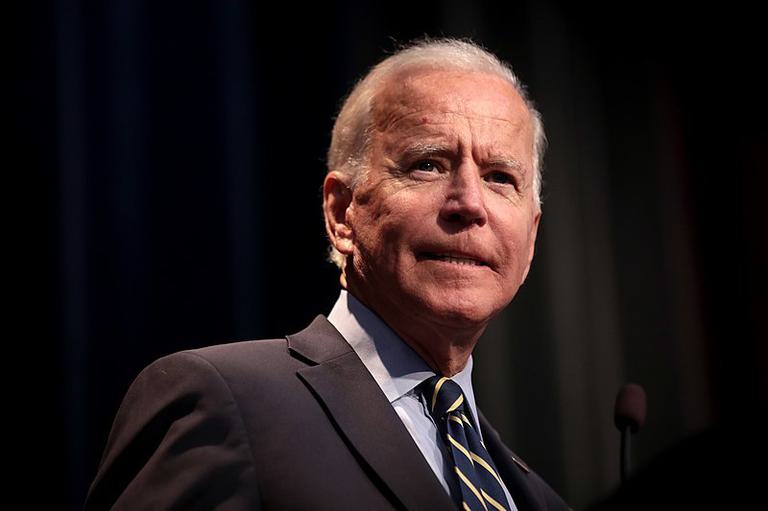

Biden tax plan points up the need for Oklahoma reform

Curtis Shelton

Massive tax increases proposed by President Joe Biden and congressional Democrats provide another reminder of the need for state tax reform in Oklahoma. One Democratic plan would result in a net tax increase of $1.3 trillion, from 2022-2031, according to the Tax Foundation. While provisions in the tax plan would result in a net reduction in taxes for Oklahoma taxpayers the first four years of the plan, that trend reverses in 2026 and beyond.

The Tax Foundation says Oklahoma is one of several states that would enjoy a federal income tax reduction in the early part of the proposed plan’s rollout, with tax cuts exceeding $400 per filer in 2022, primarily due to temporary expansions of the child tax credit through 2025. After that, every state would experience a tax increase.

Overall, the federal tax plan would result in $2,000 more in taxes paid by each filer in the state of Oklahoma from 2022 to 2031. That would amount to a net tax increase of almost 5 percent of the state’s median adjusted gross income. Oklahoma’s economy is growing, but with a stagnant labor-participation rate and an over-reliance on the volatile oil and gas industry there is no guarantee that growth will continue.

An increased tax burden will only hamper the opportunity for growth and exacerbate the trend of Oklahomans leaving for Texas. Between 1992 and 2019 Oklahoma has lost $1.73 billion to Texas. A reversal of the Trump tax cuts would add more stress on family budgets and further the desire to move to states such as Texas that don't have an income tax.

Texas isn't alone: Florida is the national leader in net wealth migration and had a $205 billion increase. Washington, another zero income tax state, saw $30.5 billion in gained wealth.

The best solution for Oklahoma to avoid future out-migration of wealth would be to reform its tax code—in particular by eliminating the penalty on work. Ending the state income tax would help protect Oklahoma's economic growth from federal tax changes, as well as reduce population drain to a certain state just across the river.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.