Budget & Tax

Do tax rates matter?

June 25, 2019

Curtis Shelton

Do tax rates matter? Recent data may shed light on this question.

A recent article by Bloomberg highlights their analysis of net wealth migration. The analysis shows which states gained and lost the most wealth in terms of Adjusted Gross Income (AGI). It should be noted that this data was collected for 2016 from the IRS and the U.S. Census Bureau.

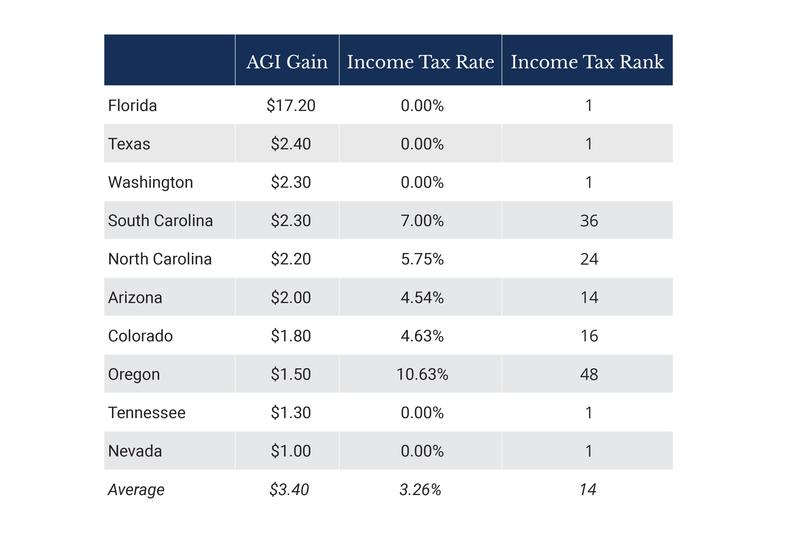

As the table below shows, the top three states with the largest net gains in AGI are Florida, Texas, and Washington, all of which have no state income tax. Five of the top 10 gainers are states without an income tax. (The 2016 income tax rank was provided by Rich States, Poor States.)

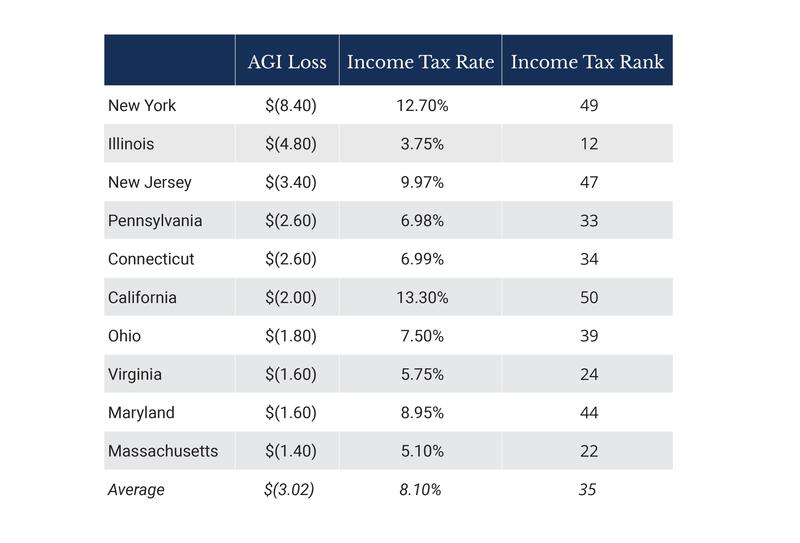

On the other end of the spectrum are the biggest losers in terms of AGI lost. New York, which lost a whopping $8.4 billion, had the second-highest income tax rate in the country at 12.70 percent. Some of the states with the highest income tax rates are on the list of biggest losers. Five of these states were in the top 10 in terms of the state income tax rate.

There were some outliers, such as Oregon and Illinois. Oregon, despite having one of the highest tax rates in the nation, saw one of the highest gains in AGI. Oregon, along with Washington, has benefited from an emerging tech market drawing young professionals to the region. Meanwhile, Illinois, which had a relatively low income tax rate in 2016, had the second-highest AGI loss as it deals with corruption scandals and numerous budget crises. (Illinois’s income tax rate has increased by 1.2 percentage points since 2016.)

This analysis is consistent with the data collected by the group How Money Walks. How Money Walks has tracked net wealth migration between each state from 1992 to 2016. The data also shows an exodus from high-tax states to low-tax states over the last two decades. So, do tax rates matter? The evidence suggests that they do.