Budget & Tax

Curtis Shelton | May 9, 2019

Economic growth, tax hikes produce record-high state revenue

Curtis Shelton

As the legislative sessions turns to its final month, the focus narrows in on the state budget. Over the last few years the budget debate has been filled with hyperbolic language that would make Stephen A. Smith blush. This year the talk has been much quieter as the legislature has record-high state revenues with which to craft a state budget. Some have attributed this abundance of state revenue to recent tax increases, while others have pointed to a growing economy.

When Oklahoma entered a statewide recession in 2015, many Oklahomans lost their jobs and Oklahomans’ total personal income declined by more than $4 billion from 2015 to 2016, according to the Bureau of Economic Analysis. Correspondingly, state revenues fell, resulting in budget shortfalls. These shortfalls caused frenzied cries for tax increases lest Oklahoma become a third-world country.

Over the next three years the legislature raised an estimated $1.1 billion in new tax and fee revenue, nearly half of which was passed last year. Simultaneously, oil prices began to rebound near the end of 2017 to almost $70 per barrel, the highest prices since 2014, before the recession began. As the economy began to recover towards the end of 2017, so too did state revenues. That growth continued throughout 2018 and resulted in record revenue collections for fiscal year 2018 at $12.1 billion. Fiscal year 2019, the current fiscal year, has followed the same trend. Even with a fall in oil prices over the holiday season, the economy continued to grow. As of now state revenue collections have outpaced last fiscal year’s collections by $1 billion, with three more months to go. State revenue collections have seen year-over-year increases 24 months in a row.

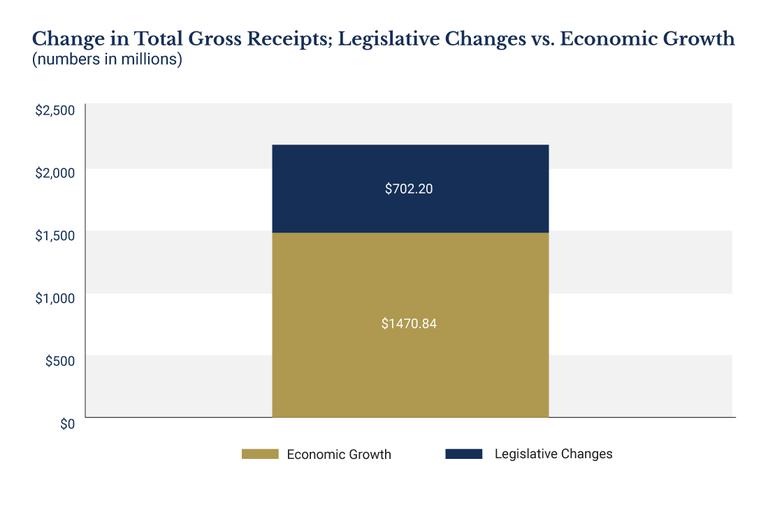

Some tax consumers may try to point to the tax increases as the main driver for these record-high revenue collections, but the data suggests otherwise. According to the State Treasurer’s office, since HB 1010xx was passed last legislative session, more than $1.4 billion of new revenue has come from economic growth while $700 million came from tax and fee increases. In other words, two-thirds of Oklahoma’s state revenue growth has come from economic growth.

Source: Oklahoma State Treasurer economic reports

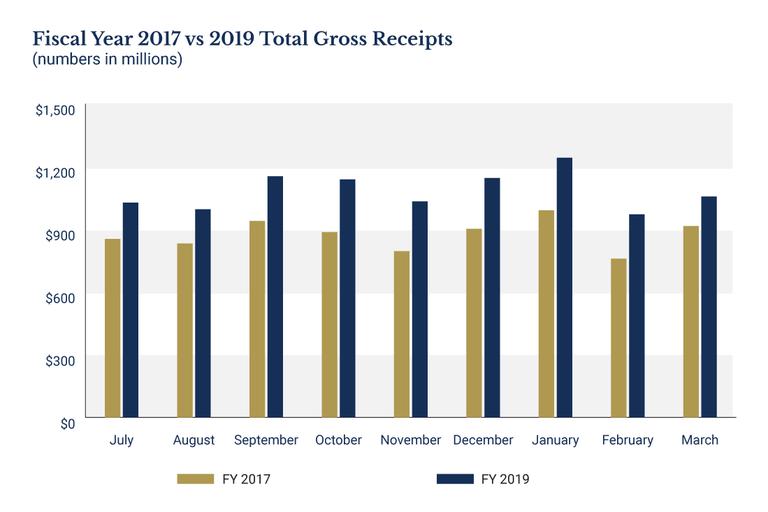

Oklahoma has experienced tremendous economic growth since the recession in 2016. Total state personal income has grown by $2.2 billion since 2016. Likewise, state revenues have grown by $1.9 billion when one compares total state revenue collections through March for fiscal year 2017 to fiscal year 2019.

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.