Budget & Tax

Income-tax cuts produce positive economic effects

May 8, 2023

Curtis Shelton

Research on income-tax rates, coupled with Oklahoma’s own experience, shows that tax cuts can be a significant part of an economic plan.

Research by Romer and Romer, for example, found that after a one-percent-of-GDP tax increase, GDP declined by three percent. Many of the changes they measure were actually tax reductions, so another way to view this would be that as tax rates fall, GDP rises. As Romer and Romer said, “tax cuts have a very large and persistent positive output effects.” Their research also showed a sharp decline in investment—a key piece in any growing and innovative economy—when tax rates rose.

Another paper, by Mertens and Olea, also found a positive relationship between income-tax cuts and GDP growth. Their paper went further, however, and examined changes in income after tax cuts. They found that income rises across all income ranges after an income-tax cut. They also found a decrease in unemployment after tax cuts.

Since 2003, Oklahoma has cut its income-tax rate from 7 percent to 4.75 percent. When measuring various economic indicators, much of what the economic literature suggested would happen has in fact happened.

When measuring state GDP there is a negative correlation between income tax rates and state GDP. In other words, this can be interpreted as when income-tax rates fall, state GDP grows.

Sources: Bureau of Economic Analysis; Oklahoma Tax Commission

One finds a similar relationship with Oklahoma’s median household income. Median income grows as tax rates fall.

Sources: Federal Reserve Bank of St. Louis; Oklahoma Tax Commission

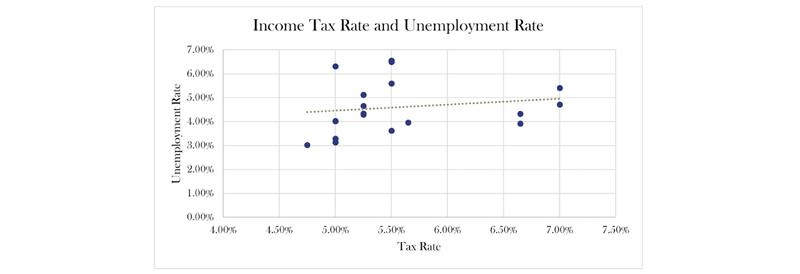

Oklahoma’s unemployment rate also seemed to move as the research would suggest it would. This graph shows a positive correlation with income-tax rates, meaning as tax rates fall so does the unemployment rate.

Sources: Federal Reserve Bank of St. Louis; Oklahoma Tax Commission

The broad research and Oklahoma’s own experience points to the fact that reducing the income tax burden produces positive effects in nearly every major economic indicator. An economic plan based around reducing income tax rates results in more jobs and higher wages.