Budget & Tax

Market downturn could wallop Oklahoma pension funds; COLA would make things worse

May 6, 2020

Curtis Shelton

Earlier this month I discussed the impact COVID-19 could have on public pensions in Oklahoma. A new analysis from Pew Charitable Trusts provides numbers to show just how severe that impact could be.

Greg Mennis, who directs The Pew Charitable Trusts’ public-sector retirement systems project, says that public pension systems are short of their annual returns by 10 to 15 percent as of now. That would be the first time since 2009 that public pensions have seen a loss in investment returns.

During the bull market of the last decade, one of Oklahoma’s largest pension systems, the Teachers’ Retirement System of Oklahoma (TRS), was able to increase its funding ratio from 50 percent to 72 percent. That sort of growth is certainly commendable, but at only 72 percent funded, downturns like the one we’re experiencing now can have significant consequences.

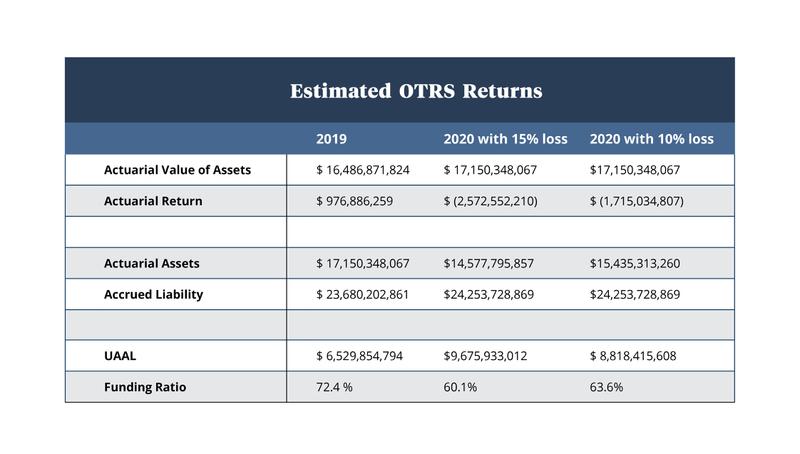

The table below shows what would happen to the TRS funding ratio if it experienced a loss of 10 and 15 percent, respectively. The accrued liability for 2020 was estimated using the average liability growth since 2009, 2.4 percent. In the worst-case scenario, TRS would see a loss of $2.6 billion in assets, while the 10 percent scenario results in a $1.7 billion loss in assets. TRS’s funding ratio would drop to the low 60’s—levels not seen since 2014.

Source: TRS actuarial reports

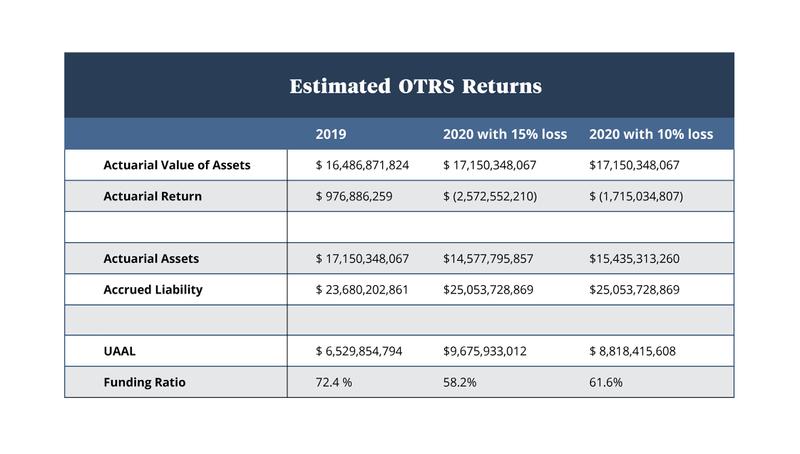

However, none of this includes what would happen if Oklahoma enacted a cost-of-living-adjustment (COLA). Legislation passed the state House in March and now goes to the Senate. The costs of the COLA are estimated to be between $800 and $900 million. The table below shows what effects the COLA could have.

Source: TRS actuarial reports

As you can see, the funding ratio could drop below 60 percent, putting at risk future beneficiaries.

The biggest problem with defined-benefit plans like TRS, as these tables show, is that costs continue to rise regardless of how much money the system receives. While promises from politicians may sound nice, they won’t mean anything if the money is not there. To ensure future beneficiaries are not harmed, changes to the pension system must be made. Moving to a defined-contribution system will help curb costs and put Oklahoma’s teachers’ retirement system on a more sustainable path.