Budget & Tax

Tax cut effects on sales tax revenue

April 16, 2018

Curtis Shelton

In a recent article, I showed that income tax cuts cannot explain Oklahoma’s recent budget challenges. And it was not only income tax revenue that increased after income tax cuts. Since 1991, income tax revenue has grown by $2.39 billion as the tax rate fell from 7% to 5%. Data from the Oklahoma Tax Commission show that these cuts also coincided with an increase in collections from the sales and use tax.

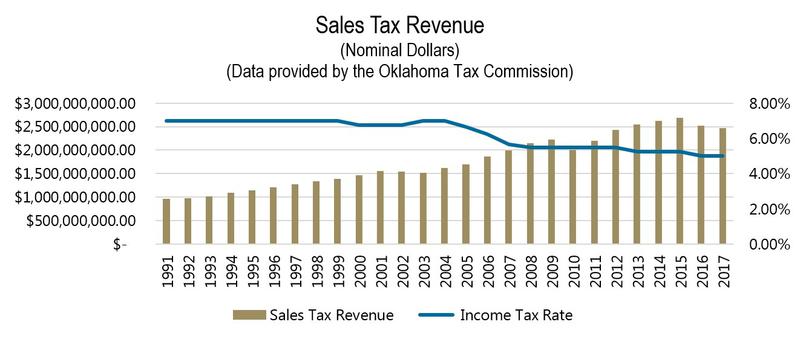

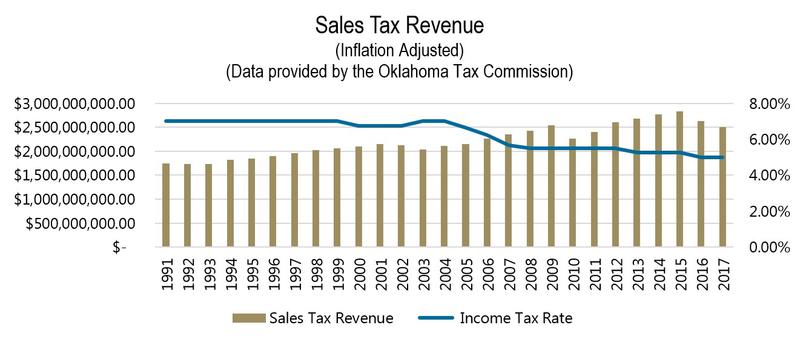

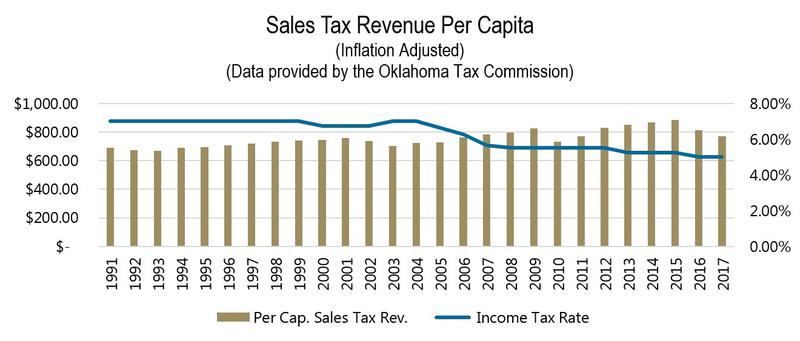

While the state sales tax rate has remained at 4.5% for the past two decades, revenue brought in from the tax has grown even when adjusted for inflation and population growth. Cuts to the income tax allow people to use more of the money they earn however they wish: saving, investing, or spending. That increase in spending can cause growth in sales tax revenue. The graphs below show how revenue from the sales and use tax has grown over the last two decades.

Since 1991, sales tax revenue has grown by 43% when adjusted for inflation. Revenue peaked in 2015 at $2.84 billion in real dollars just before the oil and gas industry slump began to impact state revenues. When measured per capita, revenues grew from $690 to $768, or an 11% increase (also adjusted for inflation). Before the 2015 drop in revenue, when the oil and gas industry lost 21,800 jobs, per capita sales tax revenue peaked 28% higher than 1991 (also adjusted for inflation). As the economy has begun to recover, there are signs of increased revenue collection. Over the first eight months of this current fiscal year, revenue from the sales and use tax has grown by $297 million during the same months of the prior year. Again, this reinforces the fact that economic growth is a driver in tax collections.

Sources: https://www.ok.gov/tax/Forms_&_Publications/Publications/Annual_Reports/index.html