Law & Principles

Ray Carter | October 21, 2020

Officials call on Congress to address McGirt challenges

Ray Carter

The Oklahoma Farm Bureau is urging Congress to approve legislation that restricts the impact of a recent U.S. Supreme Court decision regarding tribal reservations in Oklahoma.

The Farm Bureau’s request comes even as U.S. Supreme Court Justice Clarence Thomas is urging his colleagues to “mitigate” some of the “uncertainty” created by the court’s ruling in that case—McGirt v. Oklahoma.

And Oklahoma Attorney General Mike Hunter is calling on Congress to authorize state-tribal compacts that provide shared jurisdiction of criminal prosecutions, while also urging state-tribal leaders to begin work on compacts involving taxation, even though Hunter appeared to concede that will involve new tax payments by Oklahomans to tribal governments.

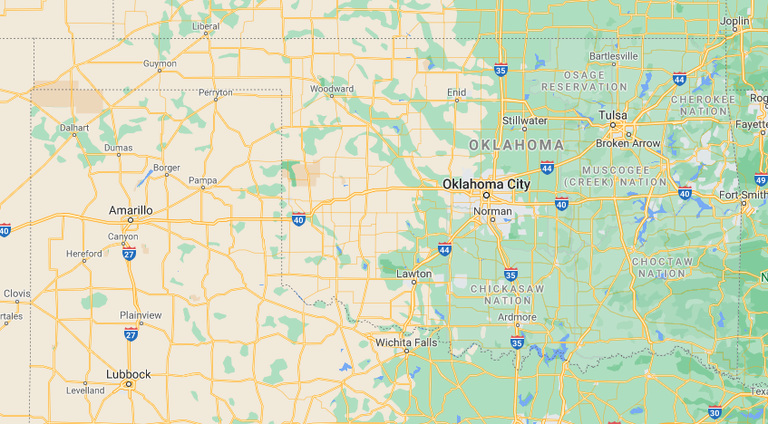

In McGirt v. Oklahoma, the U.S. Supreme Court held that the Muscogee (Creek) Nation’s reservation was never disestablished. While the ruling applied only to Creek land and questions of criminal prosecution under the federal Major Crimes Act, its precedent and basis are expected to result in application to numerous other issues, such as taxation and regulation, and also include the land of four other tribes—the Choctaw, Chickasaw, Cherokee, and Seminole nations—whose combined territory includes most of eastern Oklahoma.

In a letter sent to Oklahoma’s congressional delegation, Oklahoma Farm Bureau President Rodd Moesel wrote, “We recommend Congress enact legislation clarifying that the McGirt decision be limited to criminal jurisdiction under the Major Crimes Act and that it shall not affect the authority and jurisdiction of Oklahoma, its agencies, counties and municipalities, to regulate civil conduct or civil transactions, to tax, and to exercise judicial authority over civil matters, nor shall it enlarge the civil jurisdiction of the Five Tribes, and such authority and jurisdiction shall remain as it existed prior to the decision.”

Moesel noted the Oklahoma Farm Bureau was among the entities that submitted briefs to the U.S. Supreme Court in the McGirt case. That brief warned that if the court found the Creek reservation was not disestablished at Oklahoma statehood, as had been understood for more than a century, the court’s decision would “impact our members by authorizing tribal taxation or overturning State, county, and municipal taxation of activities and properties; investing tribal courts with broader jurisdiction or divesting State courts of long-accepted authority; and authorizing greater, and potentially exclusive, tribal and federal regulation over lands, businesses and energy resource development.”

“As an agricultural organization, we are not concerned about the Tribes physically taking nontribal private property, as much as how they could regulate natural resources and tax nontribal properties and businesses,” Moesel wrote. “Oklahoma’s farmers and ranchers are already subject to numerous state and federal regulations.”

Moesel said Oklahoma’s agriculture producers are concerned that the five tribes could “claim senior water rights” or “try to limit certain types of agricultural operations which they find objectionable,” “limit locations of certain types of agricultural operations by utilizing zoning,” and restrict hunting and fishing rights on privately owned property within a tribal reservation area.

Farmers and ranchers are also concerned the McGirt decision could allow tribes to “assert their sovereignty to tax or place fees on nontribal citizens doing business in eastern Oklahoma” or, in contrast, “propose that tribal members do not pay income” or other state taxes, creating “additional financial burden” on nontribal citizens to fund essential government services. The Farm Bureau is also concerned that any “requirement to work with multiple sovereigns” could be an obstacle “or cause a chilling effect on economic development in eastern Oklahoma.”

The Oklahoma Tax Commission has already estimated that the repercussions of the McGirt decision could reduce collection of state taxes by hundreds of millions of dollars if tribal governments assert immunity from state taxation for tribal citizens in various circumstances.

“The McGirt decision has created uncertainty in eastern Oklahoma’s future,” Moesel wrote. “We urge cooperation among all parties to successfully address state-tribal sovereignty issues. Ongoing litigation would be costly and delay progress for everyone. Our goal is a ‘win-win’ for the benefit of tribal and nontribal citizens alike.”

In a separate letter sent to Oklahoma’s congressional delegation, Hunter endorsed passage of a federal law to allow compacts that provide for concurrent state-tribal criminal jurisdiction on reservation lands.

“Federal prosecutors are doing all they can to keep up with the cases that are being handed to them, but their resources are being stretched,” Hunter said in a press release. “All the while, the state’s courts, prosecutors and corrections system are ready and willing to help. However, Congress must act to give the state and the tribes the authority to enter into these agreements.”

Hunter also said Oklahoma state government should pursue compacts on taxation issues, writing that “compacts on taxation have the possibility of easing the administration of state and tribal tax laws, increasing revenue to the tribe, and bringing certainty to state and local governments as to the revenue impact of McGirt.”

U.S. Supreme Court Justice Clarence Thomas has also spoken on the McGirt issue via a recent dissent he issued after the court declined to hear a case involving a dispute over whether a non-Indian company that leases slot machines to Cherokee casinos is exempt from county property tax.

“This case presents a square conflict on an important question: Does federal law silently preempt state laws assessing taxes on ownership of electronic gambling equipment when that equipment is located on tribal land but owned by non-Indians?” Thomas wrote. “Here, the Oklahoma Supreme Court said yes. But a few years earlier, the Second Circuit said no.”

Thomas said the court should have heard the case to address issues created by McGirt, which he noted “transformed half of Oklahoma into tribal land.” Thomas wrote that the McGirt decision had destabilized the governance of much of Oklahoma and created uncertainty about basic government functions like taxation.

“The least we could do now,” Thomas wrote, “is mitigate some of that uncertainty.”

(Image: Google Maps/Google Earth)

Ray Carter

Director, Center for Independent Journalism

Ray Carter is the director of OCPA’s Center for Independent Journalism. He has two decades of experience in journalism and communications. He previously served as senior Capitol reporter for The Journal Record, media director for the Oklahoma House of Representatives, and chief editorial writer at The Oklahoman. As a reporter for The Journal Record, Carter received 12 Carl Rogan Awards in four years—including awards for investigative reporting, general news reporting, feature writing, spot news reporting, business reporting, and sports reporting. While at The Oklahoman, he was the recipient of several awards, including first place in the editorial writing category of the Associated Press/Oklahoma News Executives Carl Rogan Memorial News Excellence Competition for an editorial on the history of racism in the Oklahoma legislature.