Budget & Tax , Health Care

Byron Schlomach, Ph.D. & Baylee Butler | November 1, 2017

Oklahoma’s highly profitable nonprofit hospitals

Byron Schlomach, Ph.D. & Baylee Butler

By Baylee Butler and Byron Schlomach

Many “nonprofit” hospitals are highly profitable entities with vast amounts of net revenue, large cash balances, profligate capital spending, and generous executive compensation. Yet they constantly plead poverty and demand ever more government spending.

Every legislative session, in every legislature in the country, the health care industry advocates that more taxpayer resources be devoted to Medicaid, Medicare, and a host of other health-related programs. The claim, along with those of other social-spending advocates, is that more money will help people who cannot otherwise afford care. In addition, the constant cry from the industry, especially hospitals, is that they are financially strapped as they struggle to meet the health demands of the indigent.

These claims, usually uncritically accepted by policymakers, do not stand up to scrutiny.

Nonprofit hospitals receive preferential tax-exempt status from the government by claiming to provide some type of charity, either free health care or some other service of public benefit, usually related to education. However, nonprofit status does not necessarily keep nonprofit hospitals from generating massive revenues, nor does it require a minimum provision of charity. In fact, the criteria for obtaining status as a nonprofit are surprisingly simple: (1) be established for an exempt purpose, such as charity or as an educational institution (hospitals generally fall in the latter); (2) earnings cannot be transferred to private shareholders or individuals; and (3) restrict political activity. These generous guidelines allow nonprofit hospitals to balloon into massive wealth creators.

Health care spending reached $3.2 trillion in 2015, a startling 17.8 percent of Gross Domestic Product, or well over one-sixth of the economy. While the health care debate has centered on statistics comparing the number insured versus uninsured, few understand why health care has become such a large portion of the economy. A major cause is that it has become increasingly expensive, substantially artificially so.

We have a government-inspired/incentivized/created health care payment system (private insurance, Medicare, and Medicaid) that pumps money into the health care sector through a non-market, irrational pricing system. As a result, many nonprofit hospitals, especially metropolitan ones, are highly profitable entities with vast amounts of net revenue and new facilities regularly under construction, such as the $150 million Mercy hospital coming to Oklahoma City.

Nonprofit hospitals’ publicly available tax submissions serve as a window into the money-bloated health sector, one that constantly cries poverty and demands ever more taxpayer resources. A better understanding of the health care sector’s financial picture will aid policymakers deliberating how best to reform the way we pay for health care.

Nonprofit Hospitals: Raking in the Cash

Seven of the top ten most profitable hospitals in the United States are registered nonprofits. Nonprofits clearly have a financial edge in the medical industry since at least some of their profitability is directly attributable to their tax-preferred status. The New England Journal of Medicine reports that nonprofit hospitals take advantage of approximately $13 billion annually in federal tax breaks. This is in keeping with data gleaned from examining IRS financial reports of Oklahoma’s nonprofit hospitals. Four of Oklahoma’s top 10 largest public charities are nonprofit hospitals. The largest overall, St. Francis Hospital Inc., has just under $1 billion in total revenue and more than $165 million in net revenue, or profit.

Getting rich is not the problem; the problem is citing financial distress under false pretenses as a basis for forcibly taking more money from taxpayers to distribute it to an industry covered up with millionaires.

Nonprofit hospitals’ reported profits (net revenues, in the Form 990 terminology) should be viewed with a healthy level of skepticism, not for being reported too high, as you might expect a corporation to do in order to maximize its stock value, but for being reported too low. While there are no regulations on the amount of profit a nonprofit can make, by virtue of being nonprofit organizations, they have an incentive to distribute their profits as costs. Unlike private organizations, nonprofits cannot distribute excess profits to investors/shareholders. Instead, some of the profit is distributed as cost through profligate capital spending and generous compensation. In addition, the optics of high profits are mitigated by claims of bad debt, or uncompensated care. These are amounts not originally intended as charitable contributions to the community or individuals but rather are billings or accounts receivable the hospital does not anticipate it will ever recoup.

Charitable care and uncompensated care help diminish what otherwise might be offensive profits. The ideal would see nonprofit hospitals fulfilling their mission by using excess revenue for public benefit by providing care at low cost to those with low incomes. However, not only do nonprofit hospitals report higher average profit margins than for-profit hospitals, the amount of charitable care reported is wanting. In fact, the difference in charitable care between nonprofit and for-profit hospitals is negligible, with nonprofits reporting approximately 4.7 percent of expenses in charitable care compared to 4.4 percent by for-profit hospitals.

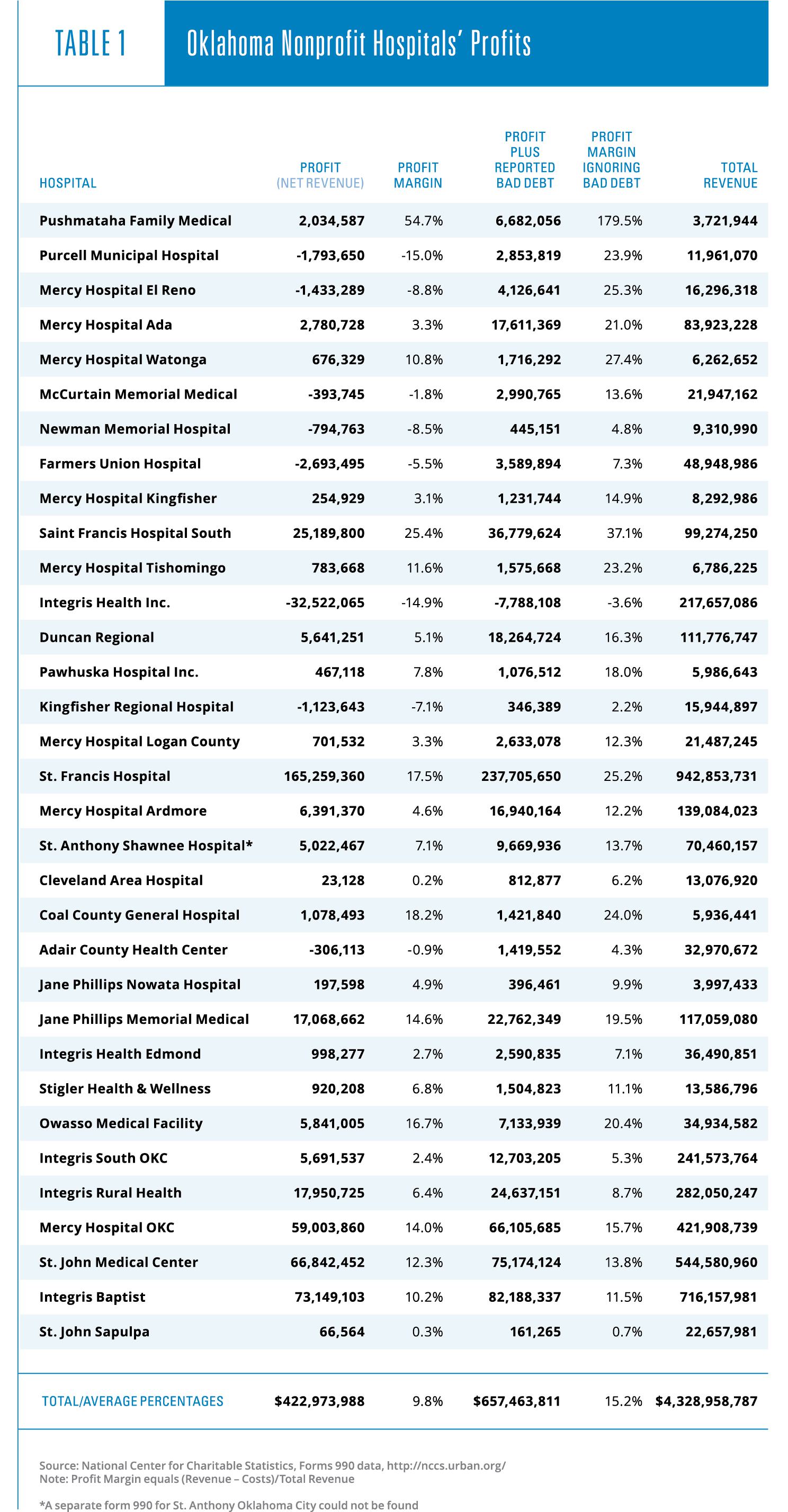

Large profits for nonprofit hospitals exist despite massive amounts claimed as bad debt. According to Steven Brill, “$39.3 billion in charity care cost the hospitals less than $3 billion to provide. That’s less than half of 1% of U.S. hospitals’ annual revenue and includes bad debt that the hospitals did not give away willingly in any event.” Because of this, it is helpful to look at nonprofits’ profit margins, both for profits calculated without subtracting bad debt and profits reported as net revenue, which does account for bad debt. These amounts for 32 nonprofit hospitals in Oklahoma can be found in Table 1.

Even net of bad debt, nonprofit hospitals in Oklahoma are generally operating with positive net revenues (9.8 percent profit margin). Not accounting for bad debt, nonprofits average a very healthy 15.2 percent profit margin. To put this in perspective, for the fiscal year ending in 2017, Macy’s reported a profit margin of 5.1 percent, and Verizon reported a margin of 21.5 percent. In 2013 the pharmaceutical industry, often cast as a villain in the health care industry by pundits and politicians, averaged a profit margin of approximately 18 percent.

Some would argue that a measure for profit not accounting for bad debt as a cost should not be used as a means of comparison. However, it is well established that hospital pricing practices do not reflect any kind of rational market-based pattern due to the prevalence of third-party payers. Those patients who must pay all or a substantial portion of their bills often balk at the outrageous sums in the bills and refuse to pay. Very often, when hospitals are paid only a portion of a bill, they write off the balance as bad debt, even though they find the payment they received sufficiently profitable and do not harass the debtor any further.

Ninety percent of health care costs are not paid directly by patients, but by insurance companies (with employers paying most of the premiums) and the government. Hospitals use highly artificial pricing that is also highly inflated compared to their costs. Consumers are unable to shop around for affordable, quality care due to the mind-bogglingly opaque and illogical pricing system. Every hospital has a price-list called a chargemaster, a highly overstated and inflated price list of all of the items and services a hospital bills to patients. The prices are continuously changing, not remotely based on cost, and unavailable to anyone wanting to know the prices of common items prior to receiving care. In fact, only 35 percent of physicians self-report that they regularly discuss costs with patients.

The truth of hospitals’ profit margins likely lies somewhere between the margins reported here, but it is important to note that the larger profit measure results in only one hospital suffering a net loss while the net revenue measure, which nets out bad debt, results in 8 hospitals suffering losses. The true financial picture of hospitals is often far from the dire picture bad debt helps them to paint for the general public and policymakers.

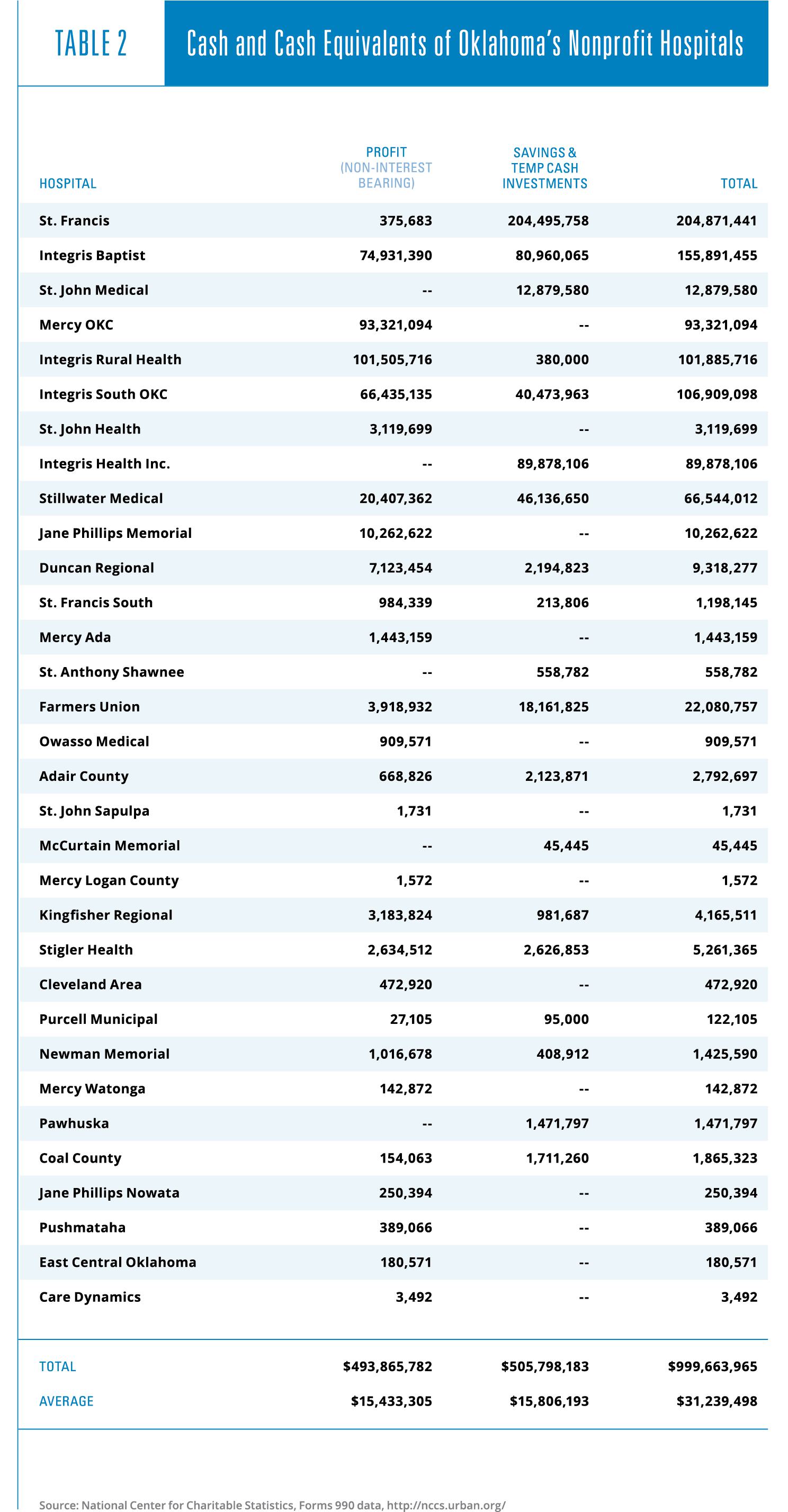

Moreover, with their sizable profit margins, nonprofit hospitals in Oklahoma are able to maintain large cash and cash-equivalent balances. These amounts show up on IRS reports as either cash, savings and temporary investments, or both. These are shown in Table 2. The 32 nonprofit hospitals reporting such balances have a total of a billion dollars of liquid funds, an average of more than $31 million per hospital. These are not amounts one would expect to see if nonprofit hospitals in Oklahoma were under financial distress.

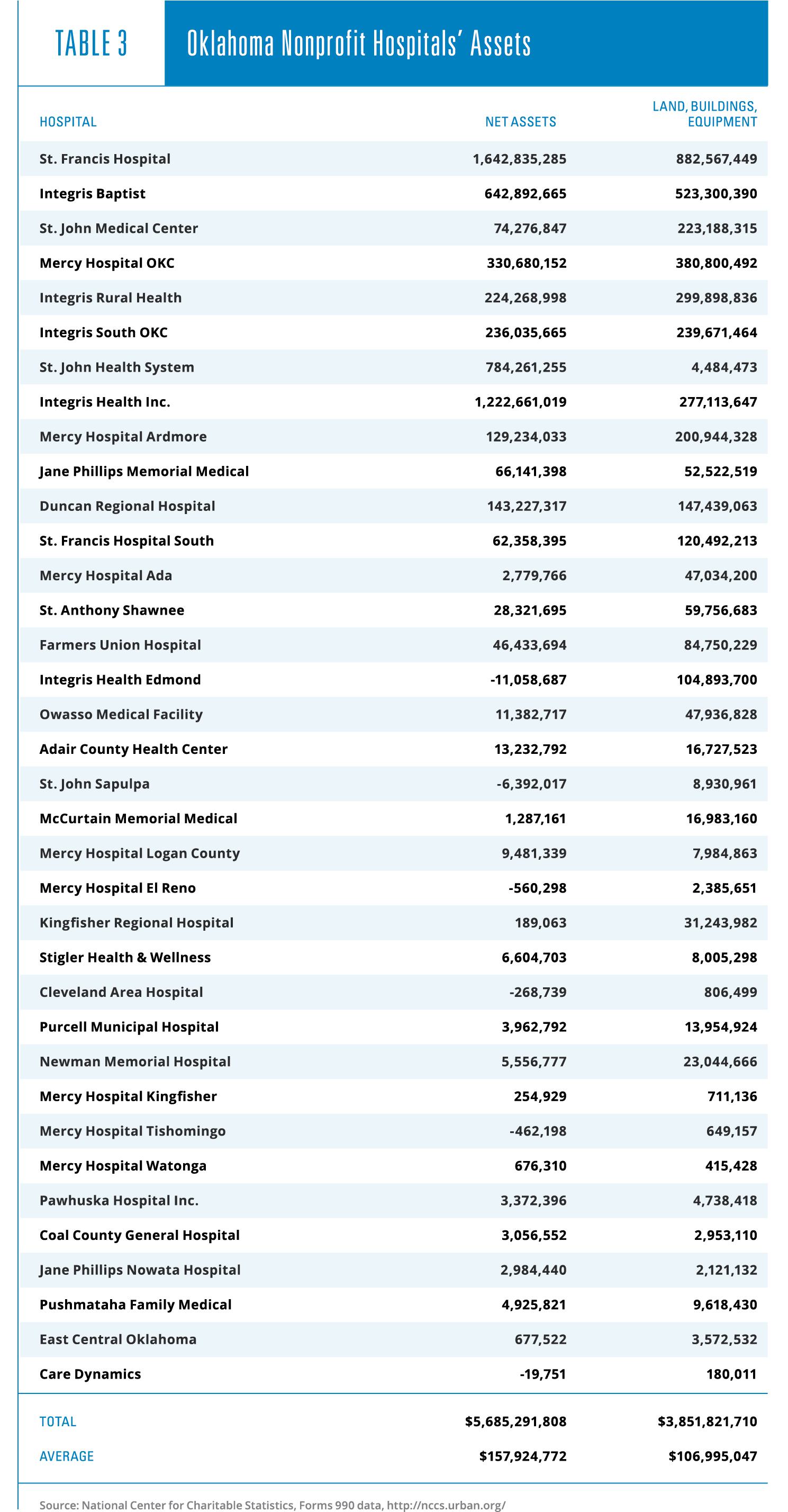

Cash does not constitute all the assets of hospitals. Most of their assets are in fixed investments, including buildings and equipment. Spending generously on these assets, as it happens, helps to reduce the appearance of profitability. As can be seen in Table 3, total net assets of the 36 Oklahoma nonprofits included in this study amount to more than $5.6 billion, an average of $158 million per hospital.

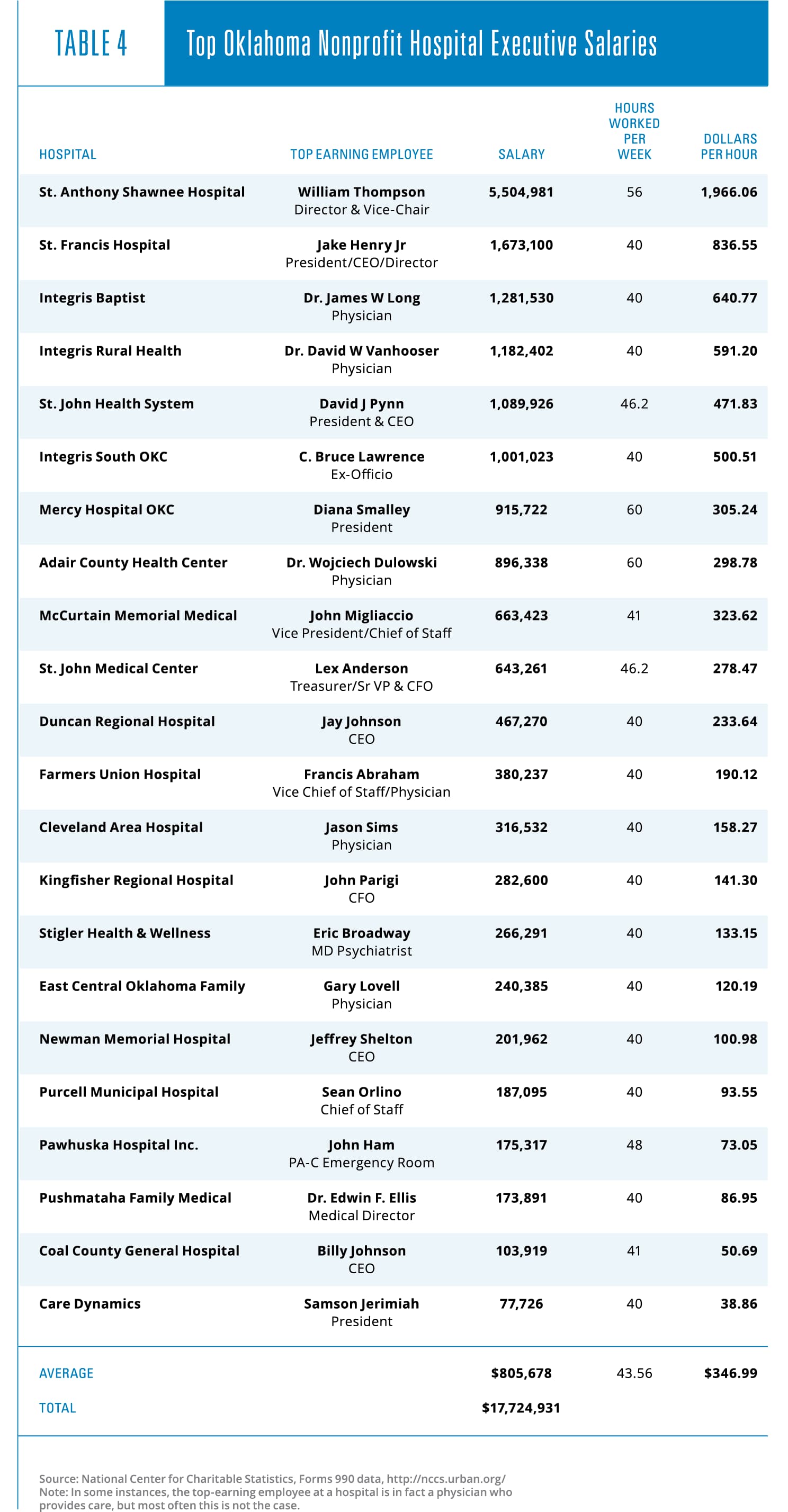

As previously noted, another way nonprofit hospitals can spend down their profits is by paying their managers eye-popping salaries and other compensation. An examination of the highest executive salary at 22 nonprofit hospitals reveals that these individuals were paid a combined total of nearly $18 million, an average of more than $800,000 each. The top executive salaries were examined at 22 separate institutions so as to avoid double-counting executives who are part of a larger chain and show up on multiple form 990s.

The bottom line: nonprofit hospitals are moneymaking businesses whose philanthropic activity is negligible, but who pay their top executives generously.

Why Nonprofit Profits Are an Issue

Profit and high levels of compensation in nonprofit hospitals are the focus of this article only to correct an impression so often promoted during budget-writing time that hospitals are constantly on the precipice of bankruptcy. In a free enterprise system, profit is a crucial component of the price system that signals where and how resources should flow to create the greatest possible amount of prosperity. Compensation for talent plays the same part. However, as already pointed out, the health care system is not subject to the free enterprise price system. Once the federal tax system encouraged employers to provide health benefits after World War II and the federal government began to cover so much of the nation’s health bill after 1965, a true price system largely ceased to operate in health care.

Today, the health care industry is a highly profitable industry that spends billions of dollars lobbying the government for an ever-increasing share of federal and state budgets. It seems that a sixth of the economy is just not enough.

Nonprofit hospitals play an active role in advocating for the expansion of government-provided healthcare through programs like Medicaid. These nonprofits claim that unpaid debts and heavy use of emergency facilities have nearly bankrupted them—problems they say can be solved by increasing government involvement. These claims hardly seem to match with the reality reported by these institutions in their federal financial documents, as cleverly constructed with bad debt and inflated salaries as these reports may be.

Providing care to those who need it is both a noble and valuable service for which people should be well compensated. Getting rich is not the problem; the problem is citing financial distress under false pretenses as a basis for forcibly taking more money from taxpayers to distribute it to an industry covered up with millionaires.

It is obvious that nonprofit hospitals and those owning and/or operating them are getting wealthy partly at taxpayers’ expense. The third-party payer system in place has given hospitals both the incentive and the ability to do so by distancing health care providers from the people who matter most—the patients. Until the American public is once again trusted to make decisions regarding their own care and the care of their loved ones, the issues present in the current system are not going to go away.

Byron Schlomach, Ph.D.

Contributor

Byron Schlomach (Ph.D. in economics, Texas A&M University) has served as director of the Center for Economic Prosperity at the Goldwater Institute and as chief economist for the Texas Public Policy Foundation. He has also served as scholar-in-residence at the Institute for the Study of Free Enterprise at Oklahoma State University. Write to him at redneckeconomist@reagan.com.

Baylee Butler

Contributing Author

Baylee Butler (M.A. in political science, Oklahoma State University) is a research associate for the 1889 Institute, an independent education and research organization.