Budget & Tax

How do Oklahoma’s casino fees compare to other states?

November 20, 2019

Jonathan Small & Curtis Shelton

Reproduction or use of the content or data is prohibited without written authorization from the Oklahoma Council of Public Affairs.

As Oklahoma’s gaming compacts are set to expire at the end of the year and Gov. Kevin Stitt has called for renegotiation of those state-tribal agreements, this paper provides information on the current system and how it compares to the taxes/fees paid by casino operators elsewhere.

One fact stands out above all others: Oklahoma has more slot machines than all but a handful of states—yet collects less revenue than most and collects that revenue off a smaller share of slot machines, than most of its counterparts.

Class II versus Class III

The federal Indian Gaming Regulatory Act outlined three classes of gaming, of which two categories apply to the current debate in Oklahoma. Class II gaming refers to bingo-style games, including electronic versions. Traditional slot machines are considered Class III gaming. Class III games also include blackjack, craps and roulette.

The passage of State Question 712 in 2004 allowed Oklahoma’s tribal governments the exclusive right to operate casinos with Class III games in exchange for payment of “exclusivity fees” to state government. The question was sold as a way to fund education. However, the exclusivity fees do not apply to Class II machines in Oklahoma’s tribal casinos, and few lay people can tell the difference between the look and operation of Class II electronic bingo games in most tribal casinos and traditional Class III electronic slot machines.

At one point, the National Indian Gaming Commission (NIGC), which regulates tribal class III gaming under the IGRA, considered adopting regulations that would clearly separate Class II and Class III machines. Had the proposed rules been adopted, many Class II electronic “bingo” games in Oklahoma casinos would likely have been considered Class III machines, subject to payment of state fees. However, the National Indian Gaming Commission eventually shelved that proposal.

That decision has had significant financial repercussions in Oklahoma.

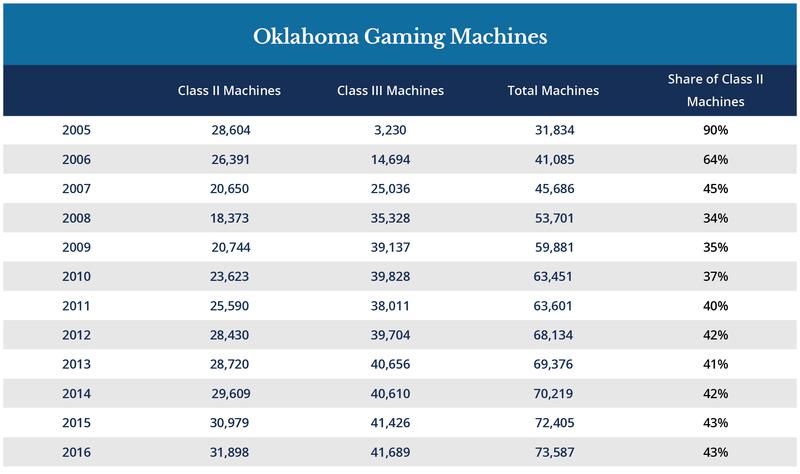

Alan Meister has kept statistics on tribal gaming and published Casino City’s Indian Gaming Industry Report for more than 20 years, and the state’s Oklahoma Game Compliance Unit’s Annual Report relies on his numbers. According to Meister’s estimates, Oklahoma’s tribal casino operators have significantly increased the number of Class II machines over the years. From 2009 through 2016 (the last year available), Meister Economic Consulting reports that the number of Class II bingo slot machines increased at a rate seven times faster than class III machines.

For 2016, Meister calculated that Oklahoma had 31,898 class II bingo slots and 41,689 class III slots for a total of 73,587 total machines.

Source: Meister, Alan, Casino City’s Indian Gaming Industry Report, 2018 Edition

Based on his calculations, tribal gaming revenue in Oklahoma from all classes of machines was more than $4.3 billion in 2016.

It’s possible Meister’s figures may understate Oklahoma casino revenue because he uses two “alternative” methods for estimating class II gaming revenue. The first method uses a personal study Meister did in 2006 that estimated that class II machines generated approximately 14 percent of all total gaming revenues at tribal casinos nationwide. In his writings, Meister has conceded “it is not likely” that the 14-percent figure is still accurate.

Meister’s other alternative method looks at four states with only class II machines (Alabama, Texas, Alaska and Nebraska) and estimates all other states’ class II revenues based on the reported numbers in those four states. Yet there are major differences between the small Class II facilities in those states and the major casinos run in Oklahoma, which now includes the largest casino in the world.

Oklahoma’s gaming compact rates

Oklahoma is the third largest gaming market in the United States behind only Nevada and California. And Oklahoma currently has a three-tiered compact rate structure that caps at a 6-percent revenue share on slot machines.

There are notable differences between tribal casinos in Oklahoma and those in other states. In most other states, tribal casinos are located on out-of-the-way Indian reservation land. That’s not the case in Oklahoma, where casinos are located on major highways and interstates and near major metro areas. That means Oklahoma casinos are able to generate much more business than their counterparts elsewhere.

Outside Nevada, commercial casinos face state revenue share rates that start at 9 percent and can go above 50 percent, with the most common rates in the 15 percent to 25 percent range.

Given its proximity and similarity to Oklahoma, it’s notable that Arkansas voters authorized four new casinos in November 2018. The tax rate on the first $150 million of revenue is 13 percent in Arkansas, and the rate rises to 20 percent thereafter.

Below is a comparison that highlights how Oklahoma government’s gaming revenue compares to other states with commercial gaming markets, based on figures from the American Gaming Association’sState of the States 2017 report. The Oklahoma figures do not include revenue generated by exempt Class II bingo slots.

Dollars in millions

[1] Source: AGA State of the States (2017)

[2] Class III only. Does not include $2 billion in class II machines untaxed by the state. Total Oklahoma gaming revenue was $4.3 billion in 2016

Meister, Alan, Casino City’s Indian Gaming Industry Report, 2018 Edition

Even if one ignores the billions in untaxed class II revenues, the maximum 6-percent fee on Class III tribal revenue numbers in Oklahoma is close to the bottom of national comparisons, despite Oklahoma being in the top three gaming states.

In Florida, revenue share rates start at 13 percent and cap out at 25 percent.

California has a wide range of rates for tribal casinos. Individual compact rates start at de minimis amounts for some smaller tribal operations and run as high as 25 percent for larger casinos.

New Mexico has a 10-percent compact rate.

The chart summarizes tribal gaming revenues by state and is based on information accumulated from the Meister’s most recent Indian Gaming Industry Report.

Dollars in millions

Source: Meister, Alan, Casino City’s Indian Gaming Industry Report, 2018 Edition

Under Oklahoma’s gaming compacts, table games (blackjack with craps and roulette recently added) are subject to a straight 10 percent fee. Comparing Oklahoma to other major tribal gaming states is difficult since ball and dice is not legal in many major tribal gaming states. Most commercial non-tribal table game states (outside Nevada) have rates in the 15 percent to 20 percent range.

Comparing slot machine fees/taxes at Oklahoma tribal casinos and state racinos.

The state of Oklahoma authorized limited casino (slot only) gaming at state racetracks as part of the 2004 state question that allowed expansion of tribal casinos. These facilities are subject to completely separate oversight by the Oklahoma Horse Racing Commission regardless of who owns a track casino. All state racetracks that have slot-machine facilities are now owned by tribal interests.

By statute, total racino slots in the state are limited to 1,000 machines. The tax rate imposed on those machines starts at 10 percent for the first $10 million in revenue and rises to 30 percent above $70 million.

In 2018 the 1,000 racino slot machines paid $24 million to state government.

In contrast, the estimated 42,000 class III tribal casino slot machines paid a total of $119M in state revenue share.

Broken down, that averages about $24,000 for each racino machine, but just $2,833 per Class III slot machine in tribal casinos. And then there are tens of thousands of Class II slot machines in tribal casinos that pay nothing to Oklahoma government.

Class II machine count numbers in Oklahoma are self-reported by tribes to a few industry consultants each year. In an August 24, 2016 article for Global Gaming Business Magazine, Dave Palermo talked with industry sources to get nationwide class II machine counts. The article summarized Class II numbers as follows:

Notably, in every other state with class III tribal gaming compacts, class II machines make up a very small percentage of total casino slot machines.

In contrast, Oklahoma has over 80 percent of the untaxed class II games in states where class III compacts have been signed.

If all Class II machines in Oklahoma were replaced with Class III machines, and rates were kept at the 6-percent fee rate, it would result in $80-90 million more in fee payments to state government. If the fee on slots were raised to rates commonly imposed in other states, the financial sums created for state government would be even larger.

The exclusivity fees paid by tribal casino operators to Oklahoma government are much lower than the tax rates paid by commercial casinos in most states and are also lower than the fees paid by comparable tribal casinos in other states. And, compared to other states, a much larger share of slot machines in Oklahoma casinos are not subject to any fee due to the huge Class II market.