Health Care

Mapping out Medicaid

July 29, 2019

Kaitlyn Finley

Key Points

- Medicaid’s rapid rise in enrollment and per-person costs continue to strain state’s budgets and contribute to the federal government’s mounting debt.

- Obamacare Medicaid expansion has exacerbated previous financial and structural problems with Medicaid and has cost taxpayers 157 percent more than what politicians promised.

- The current Medicaid spending by states is fiscally unsustainable. Wide-sweeping reforms are necessary to preserve the safety net for traditional Medicaid recipients in Oklahoma.

What is Medicaid?

Medicaid was created and is overseen by the federal government but run by the states. The program pays some or all of the cost of health care services for qualifying individuals. Legislation establishing Medicaid was passed by Congress and signed into law by President Lyndon Johnson as Title XIX of the Social Security Act in 1965.[1]

Eligibility and Benefits

Medicaid is a means-tested entitlement program; any person who meets the eligibility criteria must be provided benefits. The federal government requires that state programs cover certain people and gives states the option to cover others. Children, pregnant women, adults with dependent children, and those who are blind, aged, or disabled are generally eligible for Medicaid if they fall below certain income levels.[2]

States provide a baseline of health services and benefits to their participants, including hospital services, laboratory services, physician services, X-ray services, pregnancy-related services, and home health services.[3] States also have the option to offer additional benefits in their health care plans, such as dental insurance, prescription drugs, and hospice services.[4]

Funding

Medicaid is administered by state governments. The federal government reimburses a percentage of the states’ program expenditures using the Federal Medical Assistance Percentage (FMAP) formula. States with a lower per capita income relative to the national average receive a higher matching rate for their Medicaid expenditures and vice versa.[5]

For example, the state of New York received a 50 percent match from the federal government for every state dollar spent on their Medicaid program, while Oklahoma received a 58 percent match for state Medicaid spending for fiscal year 2018.[6] Under federal statute, FMAP rates can’t drop below 50 percent or exceed 83 percent.[7]

This is a great deal for state politicians and other state government officials. The state politician gets a “match” for each state dollar spent. Federal officials get an even better deal, since federal dollars are matched by state funds and federal officials retain ultimate power over the program. The reality, however, is that all the money comes from taxpayers, who pay both state and federal taxes.

Federal law does not require states to participate in Medicaid. The nature of the program, however, makes it practically impossible for a state to opt out. This is because a state’s residents would continue paying federal taxes—which, in part, pay for Medicaid—even if a state declined to participate. Thus, every state has participated in some form since 1982.[8]

Administering Medicaid

Each state administers its own Medicaid plan, which includes determining participants’ eligibility, setting provider reimbursement rates, and processing claims. The federal Centers for Medicare and Medicaid (CMS), administers the federal matching reimbursement funds that states receive.[9] The Oklahoma Health Care Authority (OHCA) administers Oklahoma’s state subsidized health care programs, known as SoonerCare (Oklahoma’s Medicaid program) and Insure Oklahoma. According to the OHCA’s Fiscal Year 2017 Annual Report, 1,014,983 Oklahomans received health services through SoonerCare or Insure Oklahoma.[10]

Insure Oklahoma offers health care coverage to low-income workers who do not qualify for SoonerCare. Under this plan, health insurance premiums are funded in part by the state, employers, and employees. Those who are self-employed or temporarily unemployed are also eligible to purchase this subsidized health care coverage directly from the state. Both SoonerCare and Insure Oklahoma are discussed in greater detail in Chapter Two.

Medicaid and the Affordable Care Act

In 2010, the U.S. Congress passed the Patient Protection and Affordable Care Act (ACA). One component of this legislation mandated states to extend Medicaid to adults with no dependents whose income was at or below 138 percent of the federal poverty level.[11] Most state Medicaid programs did not already cover this group of people.[12] If states did not comply, all federal reimbursement funding for their general Medicaid program would be cut.[13]

This component of the ACA was ruled unconstitutional by the U.S. Supreme Court in National Federation of Independent Business v. Sebelius (2012). States do not have to opt into this specific expansion of Medicaid under the ACA.[14] As of January 2019, 36 states, plus the District of Columbia, have accepted the expansion of Medicaid (see Chapter Three for more details regarding Medicaid expansion). Oklahoma is among 14 states that have not expanded Medicaid coverage under the ACA.[15]

Oklahoma’s Medicaid Program

SoonerCare

Oklahoma’s Medicaid program, SoonerCare, provides free and low-cost health care services to Oklahomans who meet certain requirements. SoonerCare benefits are available for low-income pregnant women and children, low-income care-takers with dependents under the age of 19, and those who are elderly, blind, or disabled.[16]

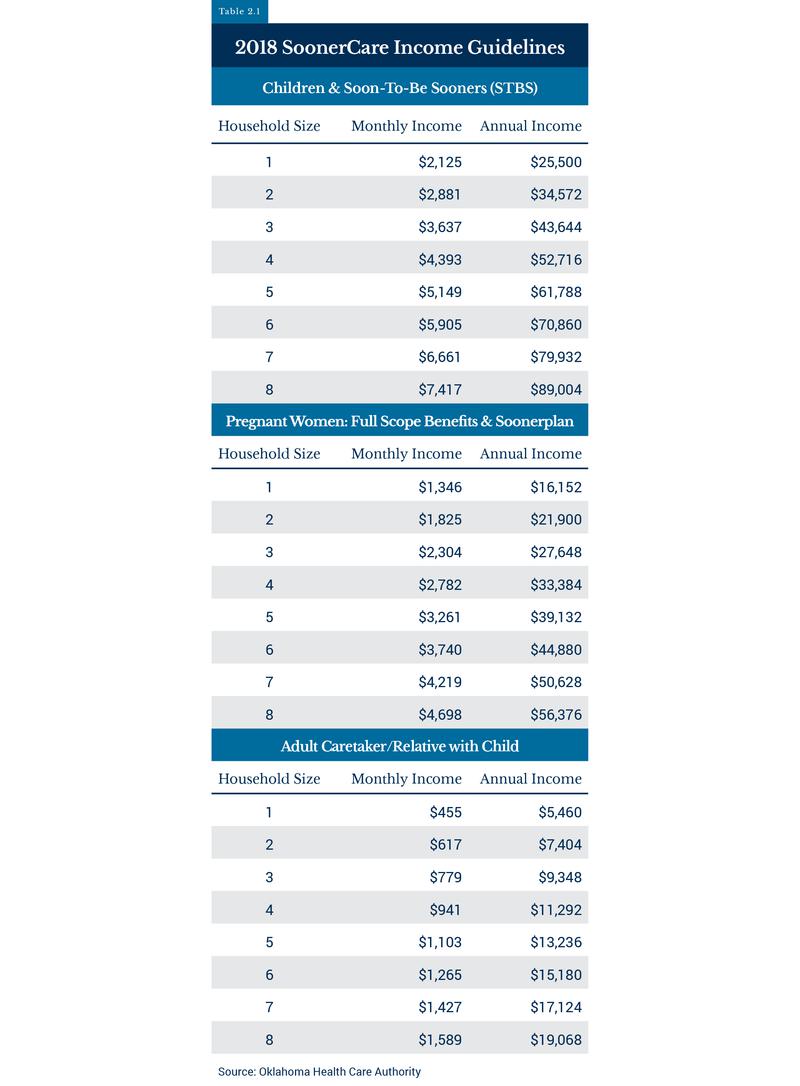

The income requirements for different eligibility groups vary, as shown in Table 2.3. The income thresholds for children are higher than other categories of beneficiaries due to an enhanced level of FMAP that states receive for children through a separate federal program known as the State Children’s Health Insurance Program (SCHIP). SCHIP is a health insurance program for children whose families have too much income to qualify for Medicaid. In 2018, SoonerCare received a 58 percent FMAP match rate, while Oklahoma’s SCHIP program received an enhanced FMAP match rate of 94 percent.[17]

Insure Oklahoma

Oklahomans who do not qualify for SoonerCare due to their income level may receive partially subsidized health insurance under another branch of Oklahoma’s Medicaid program known as Insure Oklahoma. The program is funded by both the state’s tobacco tax as well as matching federal Medicaid funds.[18] Unlike SoonerCare, Insure Oklahoma is not an open-ended entitlement program; funding for the program is limited by the amount of tobacco tax revenue generated by the state and is currently capped at approximately 28,000 individuals.[19]

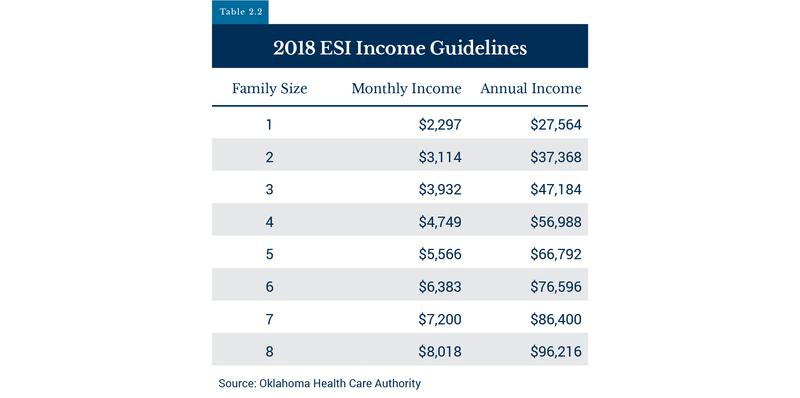

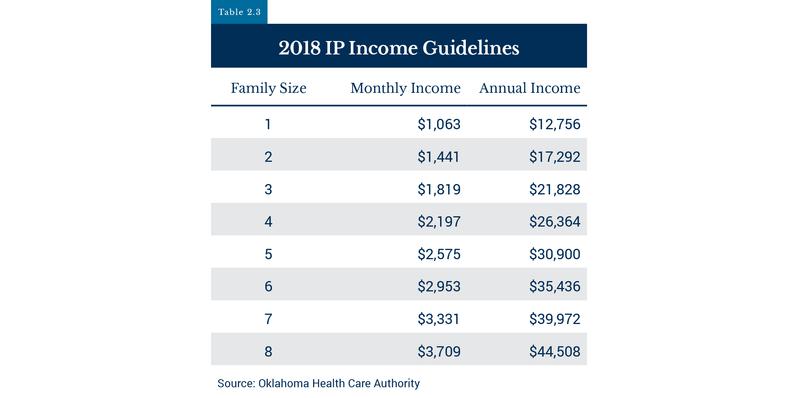

Depending on income level, employment status, and employer participation, qualifying individuals may receive subsidized health insurance coverage through two Insure Oklahoma programs: Employer Sponsored Insurance (ESI) or Individual Plan Insurance (IP) (see Tables 2.1 and 2.2).

The ESI plan offers coverage to lower-income workers. Under the ESI plan, the state, employer, and employee divide the cost of the employee’s premiums by 60, 25, and 15 percent, respectively.[20] As of January 2019, approximately 4,400 businesses participated in Insure Oklahoma’s ESI plan, with more than 13,600 individuals receiving health insurance.[21]

Those who are self-employed, temporarily unemployed, or work for a business that does not participate with the ESI program may purchase subsidized health care coverage directly from the state through Insure Oklahoma’s IP. More than 4,900 Oklahomans also gained subsidized health care coverage through the IP as of January 2019.[22]

SoonerCare’s Growing Enrollment and Rising Costs

SoonerCare enrollment has risen dramatically over the past twenty years. In 2017, 1 in 4 Oklahomans were enrolled in either SoonerCare or Insure Oklahoma. Enrollment in these medical welfare programs increased by more than 131 percent, expanding from 437,969 in 1997 to 1,014,983 in 2017.[23] In contrast, during that same time period Oklahoma’s population increased only by 16 percent, from 3,372,900 to 3,932,600 people.[24]

Much of SoonerCare’s and Insure Oklahoma’s enrollment is made up of children. In 2017, 62 percent of beneficiaries in 2017 were under the age of 20.[25] According to the Oklahoma Health Care Authority’s 2017 report, 58 percent of all births in Oklahoma were covered by SoonerCare (including enhanced federal SCHIP reimbursement funds).[26] In 2004, SoonerCare covered approximately 50 percent of all births in Oklahoma.[27] This figure has stayed relatively high over the last ten years, hovering around 60 percent.[28]

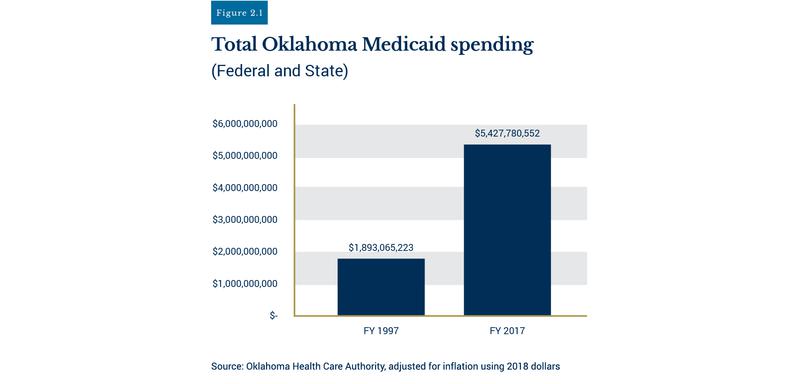

Along with ballooning enrollment, SoonerCare’s expenditures have also sharply increased over the past few decades. Total annual expenditures for the state entitlement program, including federal and state funding, increased from approximately $1.9 billion to more than $5.4 billion over the last 20 years.[29] Figure 2.1 shows SoonerCare’s total costs from 1997 to 2017.

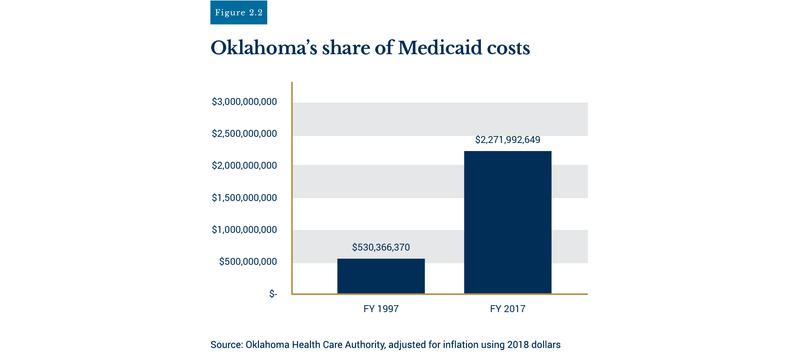

Figure 2.2 shows that Oklahoma’s share of Medicaid costs has grown from $530 million to $2.27 billion, more than a 328 percent increase since fiscal year 1997.[30]

In addition to increased costs, SoonerCare continues to account for a larger portion of state spending each year. Total expenditures for SoonerCare (including federal Medicaid matching funds), as a percentage of total state spending, have nearly doubled over the past two decades. In 1997, total SoonerCare expenditures accounted for 16 percent of total state spending.[31] Fast forward twenty years, and SoonerCare expenditures were responsible for 30 percent of total state spending in 2017.[32] As SoonerCare’s costs rise and the size of this entitlement group grows, Oklahoma will have to cut other core services (education, public health, transportation, etc.) or be forced to raise additional revenue through tax increases.

Critical Need for Reform

Unsustainable Program Growth

Like Oklahoma, other states have experienced rapid growth in their Medicaid programs, straining state budgets. Including federal reimbursements, Medicaid accounts for nearly 30 percent of total state spending, surpassing both elementary and secondary education as the single largest budget item.[33] Ten years ago, all of Medicaid’s expenditures (including federal contributions) accounted for 20.5 percent of total state spending according to the National Association of State Budget Officers.[34]

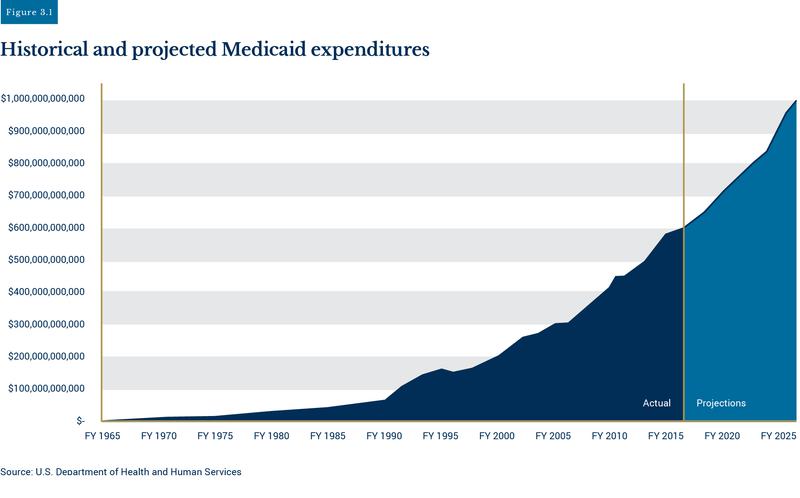

Over the past twenty years, total Medicaid enrollment has grown by 80 percent, increasing from 40 million in 1998 to approximately 72 million Americans in 2017, making it the nation's largest welfare program based on enrollment size.[35] The latest available data from the CMS projects total Medicaid expenditures in fiscal year 2017 were $592 billion. CMS projected states paid $221.6 billion, while the federal share was $370.6 billion; that amounts to 9.2 percent of the $4 trillion spent by the federal government in 2017.[36]

Total Medicaid spending is projected to increase dramatically over the next decade. According to actuarial estimates from the U.S. Department of Health and Human Services, total Medicaid expenditures could rise to $1 trillion per year by 2026.[37]

Obamacare Medicaid Expansion

Medicaid expansion has proved to be costly for all expansion states. As mentioned in Chapter One, 36 states and the District of Columbia opted to expand Medicaid programs under Obamacare to childless able-bodied, working-age adults. In order to incentivize states to expand Medicaid, the federal government paid all costs accrued from the new beneficiaries. States would still receive on average a 60 percent match for traditional Medicaid recipients: low-income pregnant women, children, the aged, and the disabled.

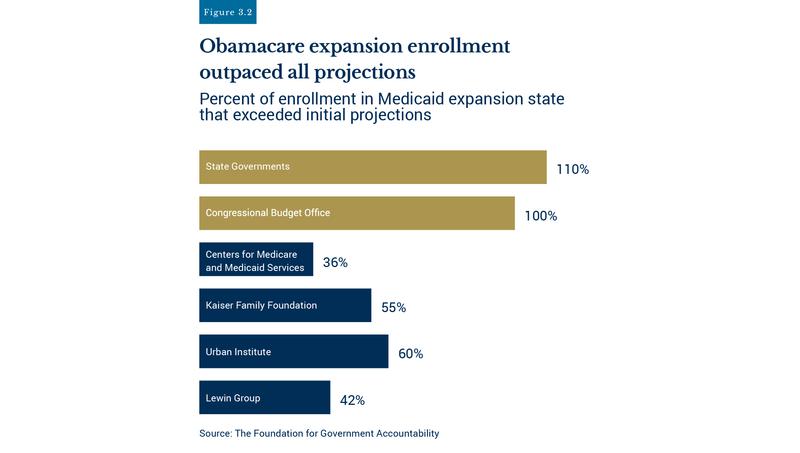

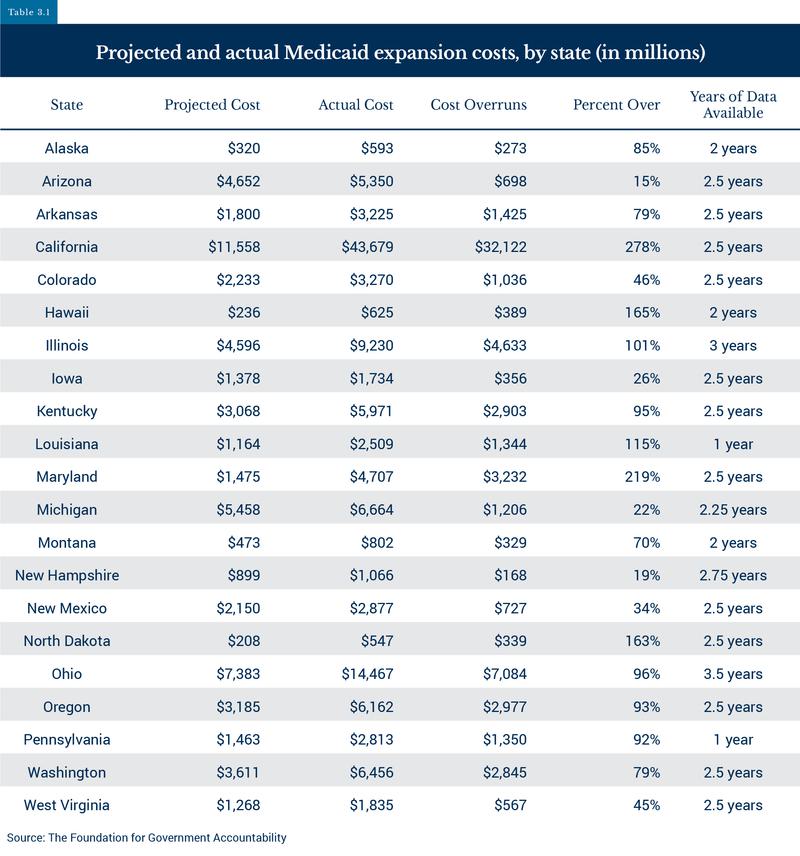

Every state that expanded Medicaid did so under the policy guidance of faulty enrollment and cost estimates. Original estimates from state agencies and other researchers grossly underestimated how many newly eligible adults would enroll. Data compiled by the Foundation for Government Accountability (FGA) show state governments’ initial projections for enrollment were exceeded by 110 percent[38] The first 24 states to expand Medicaid in 2014 and 2015 expected to enroll 5.45 million newly eligible adults in total. Instead, nearly 11.5 million signed up.[39]

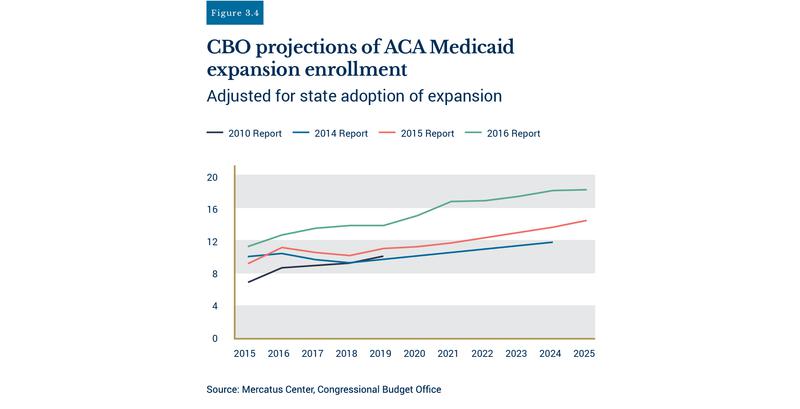

States were not alone in underestimating how many able-bodied adults would join Medicaid. Figure 3.2 shows projections from the Congressional Budget Office (CBO) underestimated enrollment by 100 percent.[40] Enrollment projections from an independent research group, the Kaiser Family Foundation, were short by 55 percent. As of 2018, more than 12.7 million expansion enrollees had signed up for Medicaid.[41]

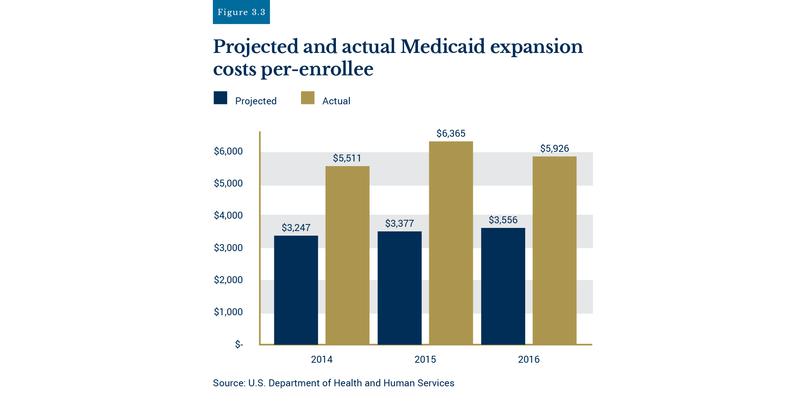

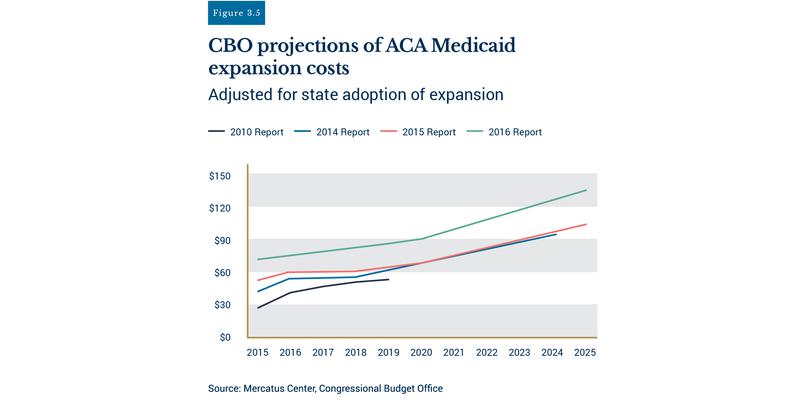

Federal agencies also underestimated the costs of new expansion enrollees. CMS underestimated per-person costs by 76 percent.[42]

Previous CBO reports compiled by the Mercatus Center show the CBO had to continually reevaluate its Medicaid expansion enrollment and cost projections.[43]

Gross underestimates of enrollment and per-person costs led to signification cost overruns for all expansion states. Obamacare expansion in West Virginia accrued $567 million in cost overruns. New Mexico’s cost projections were short by $727 million. Twelve expansion states’ cost overruns ended up more than $1 billion each. In all, Obamacare expansion has cost taxpayers 157 percent more than initial projections.[44]

Any form of Medicaid expansion, even alternative so-called “conservative” expansion plans, has shown to be much more expensive than promised. Take Arkansas, for example. In 2013, Arkansas attempted to expand Medicaid by developing a “Private Option” expansion plan. This option directed Arkansas to use Medicaid funds to purchase private health insurance in the Obamacare Exchange for newly eligible able-bodied adults.[45] The “Private Option” ended up being even more expensive than traditional expansion plans—$778 million more—according to the U.S. Government Accountability Office.[46]

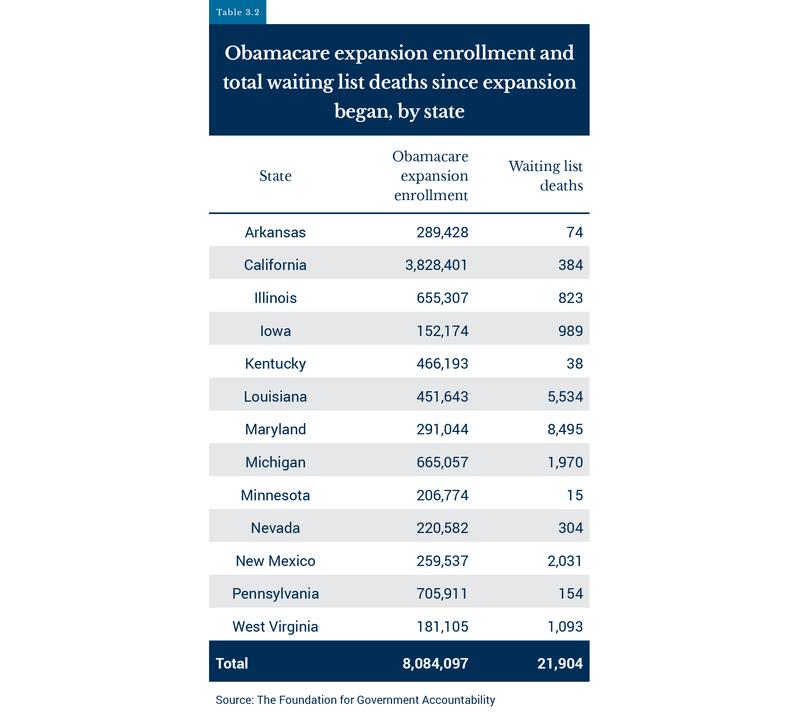

These cost overruns have adversely affected those truly in need of Medicaid. According to a 2018 FGA report, more than 650,000 people with severe intellectual disabilities, spinal cord injuries, or other debilitating conditions are on state Medicaid waiting lists.[47] Under federal law, states can use a waiver, known as Home and Community Based Waiver Program (HCBS), to provide long-term, at-home care for these people through state Medicaid programs. Because the program is optional, states often limit the number of people served, leaving others on waiting lists. When a state adopts the Obamacare Medicaid expansion, it becomes obligated to provide coverage to the entire expansion population. This forces states to prioritize care for able-bodied, working-age adults rather than people with disabilities or debilitating injuries.

Currently more than 28 million able-bodied adults are enrolled in Medicaid. Yet in 22 expansion states, nearly 250,000 people with disabilities or disabling injuries are on state waiting lists. Some face average wait times of six, seven, or even ten years on waiting lists in states like Maryland, Louisiana, and New Mexico.[48] Unfortunately, many never receive the specialized care they needed. Since the implementation of Obamacare expansion, FGA found at least 21,904 individuals on waiting lists have died in expansion states.[49]

Obamacare’s funding structure for Medicaid expansion enrollees created perverse financial incentives for states to prioritize able-bodied adults over traditional Medicaid beneficiaries: low-income pregnant women, children, the aged, and those with special needs. Under Obamacare, states will receive a 90 percent federal match for costs (beginning in 2020) accrued by able-bodied adults while only receiving on average a 60 percent match for traditional Medicaid enrollees.

The Medicaid expansion experiment has strained state budgets while simultaneously taking away resources from traditional, truly needy Medicaid beneficiaries. States must restore the integrity of Medicaid and enact real reform for their Medicaid programs (outlined in Chapter Four).

Poor Access and Health Outcomes

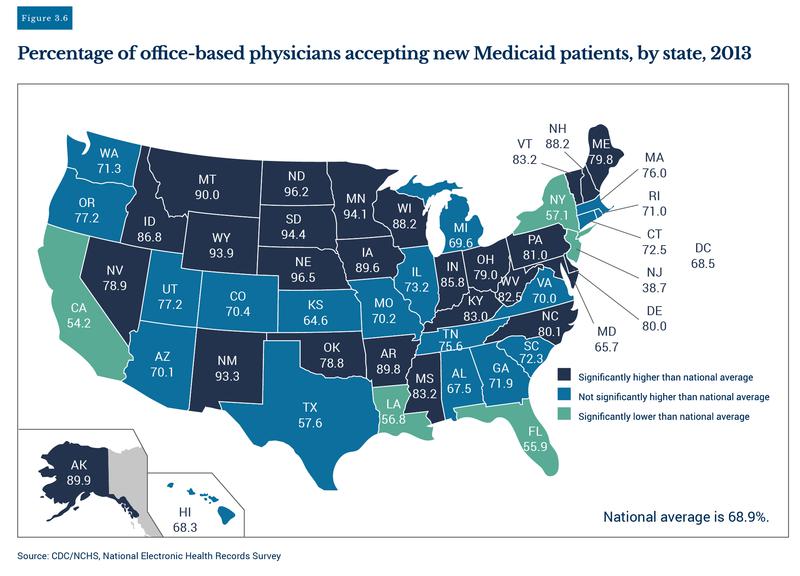

Many concerns regarding quality and access to care for Medicaid patients have been raised by physicians, academic researchers, and policy analysts in recent years. Due to much required paperwork and generally low reimbursement rates for Medicaid patients, physicians are more likely to accept Medicare or privately-insured patients. According to the Medicaid and CHIP Payment and Access Commission, “On average, Medicaid Fee for Service (FFS) physician payment rates are two-thirds of the rates Medicare pays, although this varies greatly by state and service."[50] In 2013, less than 69 percent of general physicians were accepting new Medicaid patients.[51] In general, states with higher populations, like New Jersey, California, New York, and Florida, had far lower physician participation rates for Medicaid patients, as shown by the map in Figure 3.6.

Medicaid patients may also receive overall poor quality of care, according to some academic studies. In 2008, Oregon expanded its Medicaid program to 10,000 low-income individuals using a lottery system. Economists and health care experts from Harvard and MIT recognized this was the perfect setting to conduct the first large-scale randomized control trial (accepted as the “gold standard” in medical research) on the effects of Medicaid enrollment on health outcomes.[52]

Using an array of metrics, researchers compiled health outcomes for two years for Medicaid lottery winners and compared them to those who were not selected by the Medicaid lottery. After two years, researchers found “no significant improvements in measured physical health outcomes in the first 2 years…."[53] This result sparked a backlash among advocates for Medicaid expansion or other programs to increase government involvement in health care.

Following the Oregon study, research from the University of Virginia, Johns Hopkins Hospital, and the University of Pittsburgh Cancer Institute showed Medicaid patients who had lung cancer, transplant surgeries, or other major surgical operations actually fared far worse than those who were privately insured or had no insurance at all.[54] It should be noted that although these studies found distinct correlations between Medicaid patients and poor health outcomes, the authors were hesitant to assert Medicaid causes poor outcomes. Policymakers should test outcomes in order to know what effects, if any, these programs have on those they are designed to help. In order to protect the well-being of Medicaid beneficiaries, Congress and state legislatures need to conduct oversight, which includes measuring the performance of this medical welfare program.

Rampant Program Waste and Fraud

Medicaid fraud can originate from providers and participants. Audits conducted by the federal government over recent years have shown fraud and overpayments to providers can make their way past routine state audit checks. Insufficient audit checks from state agencies have led to significant fraud and waste within Medicaid programs. In a recent report from the Government Accountability Office (GAO), federal auditors estimated improper Medicaid reimbursement payments from HHS totaled $36.2 billion, nearly 10 percent of total federal outlays for Medicaid in fiscal year 2017.[55]

Oftentimes, when federal audits identify waste and overpayments, state agencies are not able to readily recover the funds. A recent report from the U.S. HHS Office of the Inspector General (OIG) found the CMS had not recovered more than $1.6 billion in Medicaid overpayments to providers identified by previous OIG audits (2010-2015).[56] Congressional testimony from the Assistant Inspector General for Evaluations at the OIG, Ann Maxwell, highlighted specific flaws with states’ current system identifying possible fraudulent Medicaid health care providers. “When we [OIG] reviewed use of payment suspensions by several State Medicaid agencies, we found that some did not suspend Medicaid payments to all providers with credible allegations of fraud. For example, of the 81 providers with a credible allegation of fraud in Washington, the State Medicaid agency suspended Medicaid payments to only 33 of them."[57]

In addition to poor provider checks, state agencies may not effectively screen enrollee eligibility. Often, states do not have audit processes in place that flag Medicaid recipients who are no longer eligible for Medicaid. For instance, in 2014, Illinois state auditors found the state’s Medicaid program had paid $12 million for medical series for people listed as deceased in other state databases.[58] Not being able to keep track of Medicaid recipients who are ineligible due to death or change in income has cost taxpayers billions of dollars in total in recent years. According to a report released by the New York State Comptroller this past June, the New York State Health Department misspent $1.3 billion over the past six years in Medicaid premiums for people who were enrolled in other health insurance plans and ineligible for Medicaid benefits.[59] In November 2018, state auditors discovered the Louisiana Department of Health (LDH) may have spent $61 to $85 million on ineligible Medicaid enrollees due to insufficient audits. The LDH did not properly track and verify new Medicaid expansion enrollees’ income eligibility. Instead, enrollees were allowed to self-report wage changes throughout their first year in the program.[60]

These examples of waste and poor oversight in state Medicaid programs highlight the immediate need for stronger and more frequent audits. State auditors must safeguard the integrity of state Medicaid programs and verify that state agencies can effectively catch waste and fraud in the Medicaid system.

Policy Recommendations

Oklahoma Policy Recommendations

Much of the current debate surrounding whether or not Oklahoma should expand Medicaid is centered around rising health care costs and the recent financial struggles of some hospitals in rural areas. Although rural health care in Oklahoma does in fact need financial help due to the fact of decreasing rural populations and lack of providers, expanding Medicaid is not the right policy solution to fix health care in rural or urban areas or lower health care costs for all Oklahomans.

Instead of accepting Medicaid expansion and creating a new entitlement class adding hundreds of thousands of able-bodied adults to Oklahoma’s swelling Medicaid rolls, Oklahoma should instead help rural hospitals directly.

Restructure Oklahoma Health Care Authority

(Adopted in March 2019)

To ensure Oklahoma’s Medicaid program and overall agency accountability inside the Oklahoma Health Care Authority (OHCA), Oklahoma’s governor must have the ability to directly appoint and fire OHCA’s agency directors. In March 2019, Governor Stitt signed legislation to restructure the OHCA into a cabinet-level agency, giving the governor the authority to directly appoint OHCA’s Medicaid director.[61] This reform will ensure the governor has the ability to hold the CEO and those making key operational decisions directly accountable to the governor for their actions.

Redirect Tobacco Settlement Payments

To improve funding for rural health care in Oklahoma, lawmakers should dedicate all future annual payments from the 1998 Master Settlement Agreement with tobacco companies to invest rural health care infrastructure. Redirecting these funds could provide rural health care providers in Oklahoma with an additional $70 million annually.

Adjust Oklahoma Provider Rates

Oklahoma lawmakers and OHCA should decouple and adjust the various state Medicaid provider rates based on need, so that critical services like nursing home care, rural primary care, rural hospital care, and other critical services with limited revenue streams can be prioritized for funding.

State Policy Recommendations

Incentivize Bundled Pricing

To lower costs and improve quality for Medicaid beneficiaries, Oklahoma should incentivize Medicaid providers to offer bundled pricing for health care services. With bundled pricing, providers are paid a predetermined amount for services associated with an episode of care, such as knee or hip surgery.

In recent years, Medicare has utilized bundled pricing for selective procedures with great success. A 2017 study conducted by the University of Pennsylvania School of Medicine found the bundled payment model utilized by select hospitals in San Antonio cut Medicare costs for joint replacement surgeries by more than 20 percent, and patients’ quality of care stayed constant and, in some cases, actually improved.[62] With the bundled services payment model, medical providers have a direct incentive to eliminate wasteful costs and provide the best quality care. Coupled with quality metrics, bundled pricing can cut Medicaid costs while also improving health outcomes for beneficiaries.

State Medicaid agencies should financially incentivize Medicaid beneficiaries to choose providers who utilize bundled pricing. If the bundled price for a surgery offered by one provider is substantially lower than other hospitals in the area, the state could pocket most of the savings and also pass some of the savings to the beneficiaries through a Health Savings Account.

Direct Primary Care

State agencies should transition their Medicaid programs to allocate funds to enroll beneficiaries in Direct Primary Care Services (DPCS). DPCS clinics provide primary health care services to patients for a low monthly subscription fee, instead of using insurance or co-pays. Since they cut out the insurance middleman, DPCS are able to offer lower prices for their services than traditional primary care doctors.[63] Through a pilot program, state Medicaid programs could contract with DPCS directly and provide quality primary care, and other types of care for Medicaid beneficiaries while saving taxpayer dollars.

Improve Audit Processes

As state Medicaid programs grow in size, more effective audits are necessary. State Medicaid agencies must use every available tool to weed out fraud and abuse. In response to the poor state audit back in November 2018 (discussed in the previous chapter), the Louisiana Department of Health announced they would improve their audit system by connecting their state Medicaid auditing system with more state databases, including data from the Louisiana Workforce Commission, in order to provide better real-time verification of citizenship, income, and other eligibility requirements.[64] Other states, like Massachusetts, have implemented automated analytical data processing systems in their Medicaid audit checks with successful results. Massachusetts’ state Medicaid agency was able to drastically improve their efficiency and accuracy and saved taxpayers an estimated $250 million in 2016.[65]

States should also harness new analytical technology, including blockchain technology, in order to improve accuracy and efficiency with detecting fraud, and also protecting beneficiaries’ personal information from cyber hacking. With blockchain technology, transaction data are encrypted into an unchangeable data block that can be used to identify an individual’s profile. Blockchain technology, could better comb through mountains of eligibility data scattered throughout different government databases. When fully implemented, this could eliminate the need to keep large virtual data warehouses that are susceptible to hacking.[66]

Last year Oklahoma took legislative action to improve the accuracy of routine Medicaid audit checks. In March 2018, then-governor Mary Fallin signed into law the Act to Restore Hope, Opportunity, and Prosperity for Everyone (the HOPE Act).[67] The HOPE Act requires OHCA to verify on a quarterly basis participants’ earned and unearned income, employment status, residency status, immigration status, financial resources, and enrollment status in other state-administered assistance programs, as well as their participation in out-of-state public assistance programs. OHCA is also required to cross-reference Medicaid recipients with new death records, incarceration reports, and lottery winnings to prevent improper subsidies or purposeful fraud. All states should follow Oklahoma and others’ suit and ensure that Medicaid rolls are being audited at least on a quarterly basis.

Enact Work Requirements

In addition to strengthening Medicaid audit systems, states should enact work requirements for certain eligible Medicaid recipients. According to Census Bureau data compiled by FGA, a majority (55 percent) of able-bodied Medicaid enrollees are not employed.[68] As of April 2019, CMS has approved eight states’ request to implement work and community engagement waivers (also called work requirement waivers) for certain Medicaid recipients. Nine states, including Oklahoma, have a work requirements waiver request currently pending with CMS. New Hampshire and Indiana have already implemented work requirements in their Medicaid programs.[69]

Each state’s work requirements differ, but generally the requirements only apply to non-disabled, working-age adults. Many activities other than traditional full-time or part-time employment may satisfy state work requirements, including participating in community service, attending vocational training, or attending state-sponsored job search training programs. Those who do not engage in the required activities may temporarily lose their Medicaid benefits.

Stop Medicaid Expansion

States that have not expanded Medicaid, like Oklahoma, should stand firm and reject any effort to expand Medicaid. As discussed in the previous chapter, Medicaid expansion under Obamacare has taken away finite resources from traditional needy Medicaid recipients, and redistributed them to able-bodied, working-age adults.

Federal Policy Recommendations

Structural Reform—Adopt block grants for Medicaid programs

Congress must change Medicaid’s funding structure, so states have the legislative authority and financial incentive to improve their Medicaid programs. Much of the implementation of the aforementioned state reforms could be accelerated if Congress would give states more control with administering their Medicaid programs. Under current federal law, each state’s Medicaid program is funded by a combination of state and federal dollars. These federal dollars come with very expensive strings attached. There are more than 1,800 federal regulations regarding eligibility, cost sharing, financing, and data collection (to name a few) that states must follow.[70]

Not only must states adhere to thousands of regulations, but they must also turn over a portion of any savings from state-initiated, cost-saving measures. States don’t get to keep all of their “saved dollars” in their state. With this structure, states don’t have a strong incentive to experiment with new policies that could improve their Medicaid programs. Moreover, if states decide to go ahead with major program changes, such as work requirements, states must go through a lengthy waiver process with the federal government with no guarantees of approval. Mississippi has been waiting for 13 months to get its Medicaid work requirements waiver approved by the CMS.[71] Last year, CMS denied other states’ requests for control over Medicaid drug pricing and lifetime Medicaid limits for beneficiaries in their programs.[72]

In order for states to achieve new cost-saving measures, Congress must replace the current matching fund system and instead allot a fixed amount—a block grant—to each state’s Medicaid program. Each state would receive a lump sum based on previous state spending levels and enrollment, and the amount would be indexed annually to account for inflation and other factors. States would have strong incentives to implement more cost-saving measures and proactively stop waste and inefficiencies in their Medicaid programs. Block grants would allow state legislatures and the federal government to better forecast their budgets and could result in substantial savings. Adopting block grants could save the federal government $128 billion by 2026, according to a Cato Institute report based on Congressional Budget Office projections.[73]

As American health care spending continues to escalate and even outpace national gross domestic product growth, it is imperative that Congress, federal regulators, and state legislatures reform Medicaid.[74] States need to have the freedom to experiment with new cost-saving measures that will be tailored to fit their truly needy Medicaid populations. Simply going along with current Medicaid policies will push all state and federal budgets past the breaking point, inevitably eroding all safety nets and bankrupting the nation.

- [1]

Medicaid.gov, “Program History,” https://www.medicaid.gov/about....

- [2] Medicaid.gov, “Eligibility,” https://www.medicaid.gov/medicaid/eligibility/.

- [3] The Kaiser Family Foundation (Kaiser), “Medicaid: A Primer: Key Information on the Nation’s Health Coverage Program for Low-Income People,” March 2013, 13, https://kaiserfamilyfoundation.files.wordpress.com/2010/06/7334-05.pdf.

- [4] Ibid., 14.

- [5] Medicaid and CHIP Payment and Access Commission, “Medicaid 101: Financing,” https://www.macpac.gov/medicaid-101/financing/.

- [6] Kaiser, “Federal Medical Assistance Percentage (FMAP) for Medicaid and Multiplier” 2018. https://www.kff.org/medicaid/state-indicator/federal-matching-rate-and-multiplier/?currentTimeframe=2&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D.

- [7] Medicaid and CHIP Payment and Access Commission, “Medicaid 101: Financing,” https://www.macpac.gov/medicaid-101/financing/.

- [8] Kaiser, “Medicaid: A Timeline of Key Developments,” 2008. https://kaiserfamilyfoundation.files.wordpress.com/2008/04/5-02-13-medicaid-timeline.pdf

- [9] Kaiser, “Medicaid: A Primer: Key Information on the Nation’s Health Coverage Program for Low-Income People,” March 2013, 5, https://kaiserfamilyfoundation.files.wordpress.com/2010/06/7334-05.pdf.

- [10] Oklahoma Health Care Authority (OHCA), “2017 Annual Report,” 2, See Archived Annual Reports, SFY 2017 OHCA Annual Report. http://www.okhca.org/research.aspx?id=87

- [11] Kaiser, “A Guide to the Supreme Court’s Decision on the ACA’s Medicaid Expansion,” 3, https://kaiserfamilyfoundation.files.wordpress.com/2013/01/8347.pdf.

- [12] Ibid., 2.

- [13] Ibid., 1.

- [14] Ibid., 4.

- [15] Kaiser, “Status of State Medicaid Expansion Decisions: Interactive Map,” https://www.kff.org/medicaid/issue-brief/status-of-state-medicaid-expansion-decisions-interactive-map/.

- [16] OHCA, “SoonerCare Qualification Guidelines,” https://www.okhca.org/individuals.aspx?id=124.

- [17] Kaiser, “Enhanced Federal Medical Assistance Percentage (FMAP) for CHIP,” FY 2018, https://www.kff.org/other/state-indicator/enhanced-federal-matching-rate-chip/?currentTimeframe=2&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

- [18] OHCA, “Press Release: Insure Oklahoma Program Renewal Approved until 2023,” https://www.insureoklahoma.org/about.aspx?id=22514.

- [19] OHCA, “Strategic Plan SFY 2017-2018,” 11, January 2017 Update, https://www.ocpathink.org/assets/img/20190408150652.pdf

- [20] Ibid.

- [21] InsureOklahoma.org, “Fast Facts: Insure Oklahoma ESI and IP Detail,” 1, http://www.insureoklahoma.org/IOaboutus.aspx?id=4096.

- [22] Ibid., 2.

- [23] OHCA Open Records Request, September 26, 2018, https://www.ocpathink.org/assets/img/ORA-Ltr-9-26-18.pdf; OHCA, “2017 Annual Report,” 2, See Archived Annual Reports, SFY 2017 OHCA Annual Report. http://www.okhca.org/research.aspx?id=87

- [24] Data from US Census Bureau, https://www.google.com/publicdata/explore?ds=kf7tgg1uo9ude_&met_y=population&hl=en&dl=en#!ctype=l&strail=false&bcs=d&nselm=h&met_y=population&scale_y=lin&ind_y=false&rdim=country&idim=country:US&idim=state:40000&ifdim=country&hl=en_US&dl=en&ind=false.

- [25] OHCA, “2017 Annual Report,” 2, See Archived Annual Reports, SFY 2017, http://www.okhca.org/research.aspx?id=87.

- [26] Ibid., 3.

- [27] OHCA, “2004 Annual Report,” 6, See Archived Annual Reports, SFY 2004, http://www.okhca.org/research.aspx?id=87.

- [28] OHCA, “2010 Annual Report;” 8; OHCA, “2014 Annual Report,” 10. See Archived Annual Reports, SFY 2010 and SFY 2014, http://www.okhca.org/research.aspx?id=9662&parts=7447.

- [29] Data provided by OHCA, “2005 Annual Report,” 18; OHCA, “2017 Annual Report,” 17, See Archived Annual Reports, SFY 2005, 2017, http://www.okhca.org/research.aspx?id=87. All numbers adjusted for inflation using 2018 dollars.

- [30] Ibid.

- [31] Data provided by OHCA, “2005 Annual Report,” 18, See Archived Annual Reports, SFY 2005, http://www.okhca.org/research.aspx?id=87; “Oklahoma Comprehensive Annual Financial Report: 1997,” Office of Management and Enterprise Services, 14, https://apps.ok.gov/OSF/documents/97cafr1.pdf. All numbers adjusted for inflation using 2018 dollars.

- [32] Data provided by OHCA, “2017 Annual Report,” 17, See Archived Annual Reports, SFY 2017, http://www.okhca.org/research.aspx?id=87; “Oklahoma Comprehensive Annual Financial Report: 2017,” Office of Management and Enterprise Services, 12, https://www.ok.gov/OSF/documents/cafr2017.pdf. All numbers adjusted for inflation using 2018 dollars.

- [33] National Association of State Budget Officers, “2018 State Expenditure Report: Fiscal Years 2016-2018,” 3, https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b750-0fca152d64c2/UploadedImages/SER%20Archive/2018_State_Expenditure_Report_S.pdf.

- [34] Ibid.

- [35] Kaiser, “Medicaid Facts: Medicaid Enrollment and Spending Trends,” February 2001, 1, https://kaiserfamilyfoundation.files.wordpress.com/2013/01/medicaid-enrollment-and-spending-trends-fact-sheet-3.pdf.; Medicaid and CHIP Payment and Access Commission, “MACStats: Medicaid and CHIP Data Book,” https://www.macpac.gov/wp-content/uploads/2015/01/EXHIBIT-1.-Medicaid-and-CHIP-Enrollment-as-a-Precentage-of-the-U.S.-Population-2017.pdf.; Kimberly Amadeo, “US Welfare Programs, the Myths Verus the Facts,” The Balance, June 25, 2019, https://www.thebalance.com/welfare-programs-definition-and-list-3305759.

- [36] Centers for Medicare & Medicaid Services, “2017 Actuarial Report on the Financial Outlook for Medicaid,” iv. https://www.cms.gov/Research-Statistics-Data-and-Systems/Research/ActuarialStudies/Downloads/MedicaidReport2017.pdf.

- [37] Ibid., 8.

- [38] Jonathan Ingram and Nicholas Horton, “A Budget Crisis in Three Parts: How ObamaCare is Bankrupting Taxpayers,” FGA, February 1, 2018, 5, https://thefga.org/wp-content/uploads/2018/02/A-Budget-Crisis-In-Three-Parts-2-6-18.pdf.

- [39] Jonathan Ingram and Nicholas Horton, “ObamaCare Expansion Enrollment is Shattering Projections,” FGA, November 16, 2016, 2, https://thefga.org/wp-content/uploads/2016/12/ObamaCare-Enrollment-is-Shattering-Projections-1.pdf

- [40] Jonathan Ingram and Nicholas Horton, “A Budget Crisis in Three Parts: How ObamaCare is Bankrupting Taxpayers,”FGA, February 1, 2018, 5, https://thefga.org/wp-content/uploads/2018/02/A-Budget-Crisis-In-Three-Parts-2-6-18.pdf.

- [41] Jonathan Ingram and Nicholas Horton, “How the ObamaCare dependency crisis could get even worse — and how to stop it,” FGA, January 16, 2018, 5, https://thefga.org/wp-content/uploads/2018/01/How-the-ObamaCare-dependency-crisis-could-get-even-worse-%E2%80%94-and-how-to-stop-it-1-15-18.pdf.

- [42] Jonathan Ingram and Nicholas Horton, “A Budget Crisis in Three Parts: How ObamaCare is Bankrupting Taxpayers,”FGA, February 1, 2018, 6, https://thefga.org/wp-content/uploads/2018/02/A-Budget-Crisis-In-Three-Parts-2-6-18.pdf.

- [43] Brian C. Blase, “Evidence Is Mounting: The Affordable Care Act Has Worsened Medicaid’s Structural Problems,” Mercatus Research Center, Sept. 2016, 16-18, https://www.mercatus.org/system/files/mercatus-blase-medicaid-structural-problems-v1.pdf.

- [44] Jonathan Ingram and Nicholas Horton, “A Budget Crisis in Three Parts: How ObamaCare is Bankrupting Taxpayers,” FGA, February 1, 2018, 6-7, https://thefga.org/wp-content/uploads/2016/12/ObamaCare-Enrollment-is-Shattering-Projections-1.pdf.

- [45] Arkansas Center for Health Improvement, “Arkansas Works Program,” February 6, 2017, 2, https://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Waivers/1115/downloads/ar/Health-Care-Independence-Program-Private-Option/ar-works-draft-eval-dsgn-2017-2021.pdf.

- [46] U.S. Government Accountability Office, “Medicaid Demonstrations: HHS’s Approval Process for Arkansas’s Medicaid Expansion Waiver Raises Cost Concerns,” August 8, 2014, 3, https://www.gao.gov/products/GAO-14-689R.

- [47] Nicholas Horton, “Waiting for Help: The Medicaid Waiting List Crisis,” FGA, March 6, 2018. 4, https://thefga.org/wp-content/uploads/2018/03/WAITING-FOR-HELP-The-Medicaid-Waiting-List-Crisis-07302018.pdf.

- [48] Ibid., 4, 7-8.

- [49] Ibid., 5.

- [50] Medicaid and CHIP Payment and Access Commission, “Provider payment and delivery systems,” https://www.macpac.gov/medicaid-101/provider-payment-and-delivery-systems/.

- [51] Ester Hing, et al., “Acceptance of New Patients With Public and Private Insurance by Office-based Physicians: United States, 2013” U.S. Centers for Disease Control and Prevention, NCHS Data Brief, No. 195, March 2015, 1-3, https://www.cdc.gov/nchs/data/databriefs/db195.pdf.

- [52] Amy Finkelstein, et al., “The Oregon Health Insurance Experiment: Evidence from the First Year,” The Quarterly Journal of Economics, vol. 127, no. 3, 2012, pp. 1057–1106, https://www.nber.org/papers/w17190.

- [53] Ibid.

- [54] Damien J. Lapar et al., “Primary Payer Status Affects Mortality for Major Surgical Operations,” Annals of Surgery, Vol. 128, 2010, pp. 148–156, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3071622/; Jeremiah G. Allen., et al., “Insurance Status Is an Independent Predictor of Long-Term Survival after Lung Transplantation in the United States,” Journal of Heart and Lung Transplantation, vol. 30, no. 1, 2011, pp. 45–53, https://www.ncbi.nlm.nih.gov/pubmed/20869264; Joseph Kwok et al., “The Impact of Health Insurance Status on the Survival of Patients with Head and Neck Cancer.” American Cancer Society, vol. 116, no. 2, 2010, pp. 476–485, https://onlinelibrary.wiley.com/doi/epdf/10.1002/cncr.24774.

- [55] U.S. Department of Health and Human Services, “Medicaid Payment Accuracy,” https://paymentaccuracy.gov/program/medicaid/.

- [56] U.S. Department of Health and Human Services Office of Inspector General, “The Centers for Medicare & Medicaid Services Had Not Recovered More Than a Billion Dollars in Medicaid Overpayments Identified by OIG Audits,” iv, https://oig.hhs.gov/oas/reports/region5/51700013.pdf.

- [57] Medicaid Oversight— Existing Problems and Ways to Strengthen the Program: Hearings Before the Committee on Energy and Commerce, Subcommittee on Oversight and Investigations, House, 115th Cong. 1st sess., January 31, 2017, (Testimony of Ann Maxwell), 11, https://oig.hhs.gov/testimony/docs/2017/maxwell-testimony01312017.pdf.

- [58] Carla K. Johnson et al., “Medicaid paid $12M for Illinois dead,” The Washington Post, April 19, 2014, www.washingtonpost.com/national/health-science/medicaid-paid-12m-for-illinois-dead/2014/04/19/f6063f5c-c7d3-11e3-8b9a-8e0977a24aeb_story.html?utm_term=.012137c77fcf.

- [59] New York State Office of the State Comptroller, “Managed Care Premium Payments for Recipients With Comprehensive Third-Party Insurance,” 1, https://osc.state.ny.us/audits/allaudits/093018/sga-2018-16s60.pdf.

- [60] Louisiana Department of Health, “Medicaid Eligibility: Wage Verification Process of the Expansion Population,” 5, https://www.lla.la.gov/PublicReports.nsf/1CDD30D9C8286082862583400065E5F6/$FILE/0001ABC3.pdf.

- [61] Chris Casteel, “Stitt signs five bills and immediately gains hiring power at five state agencies,” The Oklahoman, March 14, 2019, https://newsok.com/article/5625768/stitt-signs-five-bills-and-immediately-gains-hiring-power-at-five-state-agencies.

- [62] Amol S. Navathe, et al., “Cost of Joint Replacement Using Bundled Payment Models.” JAMA Internal Medicine, vol. 177, no. 2, 2017, p. 214, https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/2594805.

- [63] United States, Cong., Senate, Committee on Health. Education, Labor and Pensions, Reducing Health Care Costs: Improving Affordability Through Innovation, November 28, 2018, 115th Cong. 2nd sess., November 28, 2018, (statement of Lee S. Gross, President, Docs 4 Patient Care Foundation and Founder, Epiphany Health Direct Primary Care), 9, https://www.help.senate.gov/imo/media/doc/Gross2.pdf.

- [64] Louisiana Department of Health, “Louisiana Department of Health responds to Louisiana Legislative Auditor Report on Medicaid eligibility and wage verification,” http://ldh.la.gov/index.cfm/newsroom/detail/4973.

- [65] Josh Archambault et al., “MassHealth Protecting Medicaid Resources for the Most Vulnerable: How Massachusetts Saved Hundreds of Million through Enhanced Eligibility Verification,” 6, https://pioneerinstitute.org/news/study-finds-masshealths-enhanced-eligibility-verification-saves-250-million-a-year/.

- [66] Ibid., 7.

- [67] HOPE Act, 56 O.S. §§ 246 through 250, http://www.oklegislature.gov/osstatuestitle.html.

- [68] Nicholas Horton et al., “Obamacare’s Not Working: How Medicaid expansion is fostering dependency,” 4, https://thefga.org/wp-content/uploads/2018/07/MedEx-Not-Working-FINAL.pdf.

- [69] Kaiser, “Medicaid Waiver Tracker: Approved and Pending Section 1115 Waivers by State,” https://www.kff.org/medicaid/issue-brief/medicaid-waiver-tracker-approved-and-pending-section-1115-waivers-by-state/.

- [70] Medicaid and CHIP Payment and Access Commission, “Reference Guide to Federal Medicaid Statute and Regulations,” https://www.macpac.gov/reference-guide-to-federal-medicaid-statute-and-regulations/.

- [71]

Medicaid.gov, “Mississippi Medicaid Workforce Training Initiative,” https://www.medicaid.gov/medic....

- [72] John Commins, “CMS Rejects Massachusetts’ Medicaid Drug Price Plan,” Health Leaders, June 28, 2018, https://www.healthleadersmedia.com/innovation/cms-rejects-massachusetts-medicaid-drug-price-plan; Les Masterson, “CMS rejects Kansas plan to create lifetime Medicaid limits,” May 8, 2018, https://www.healthcaredive.com/news/cms-rejects-kansas-plan-to-create-lifetime-medicaid-limits/523022/.

- [73] Cato Institute, Cato Handbook For Policymakers, 8th Edition, 2017, https://www.cato.org/cato-handbook-policymakers/cato-handbook-policy-makers-8th-edition-2017/cutting-federal-spending.

- [74] CMS, “National Health Expenditure Projections 2017-2026,” 1, https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/ForecastSummary.pdf.