Budget & Tax

Curtis Shelton | May 20, 2019

Total state revenue collections hit record high

Curtis Shelton

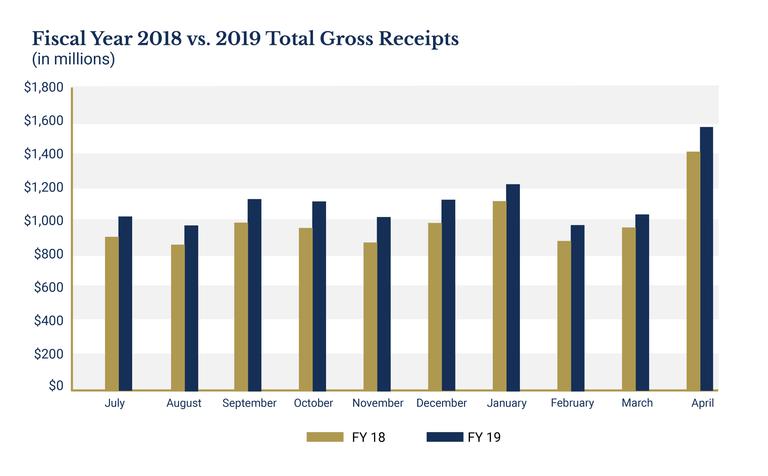

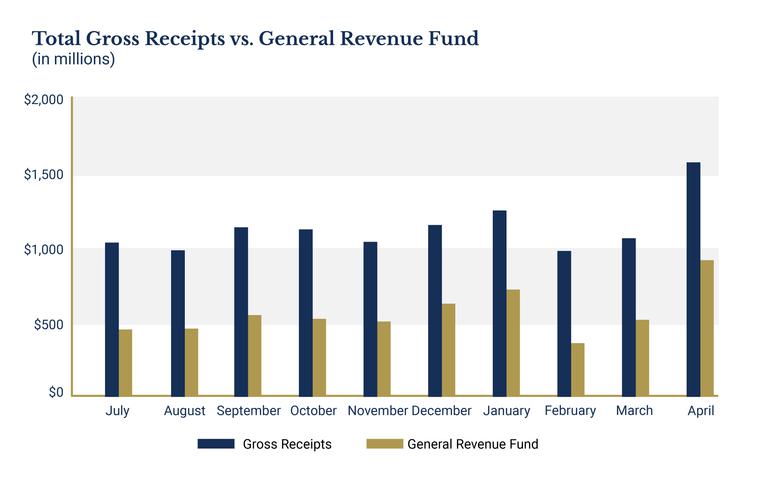

The Office of the State Treasurer, in conjunction with the Oklahoma Office of Management and Enterprise Services (OMES), last week released the monthly report for April 2019 revenue collections. Total gross receipts collected in April 2019 were $1.58 billion—an increase of 12.7 percent, or $178 million, from the same month in the prior year. The General Revenue Fund (GRF) grew 25.5 percent from the same month the previous year, collecting $509 million.

Sources: Office of the State Treasurer, monthly “Gross Receipts to the Treasury” reports; Office of Management and Enterprise Services, monthly General Revenue Fund allocation reports

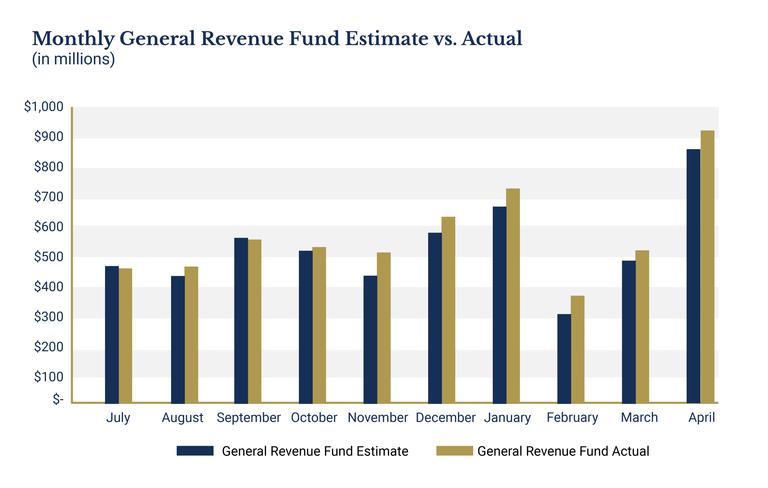

The GRF came in above the estimate by 7.1 percent. Currently the GRF has collected $4.7 billion and has grown by $850 million compared to last year. For the fiscal year, GRF collections are now $355 million ahead of the estimate. This estimate is what lawmakers used to determine the current state budget

Sources: Office of the State Treasurer, monthly “Gross Receipts to the Treasury” reports; Office of Management and Enterprise Services, monthly General Revenue Fund allocation reports

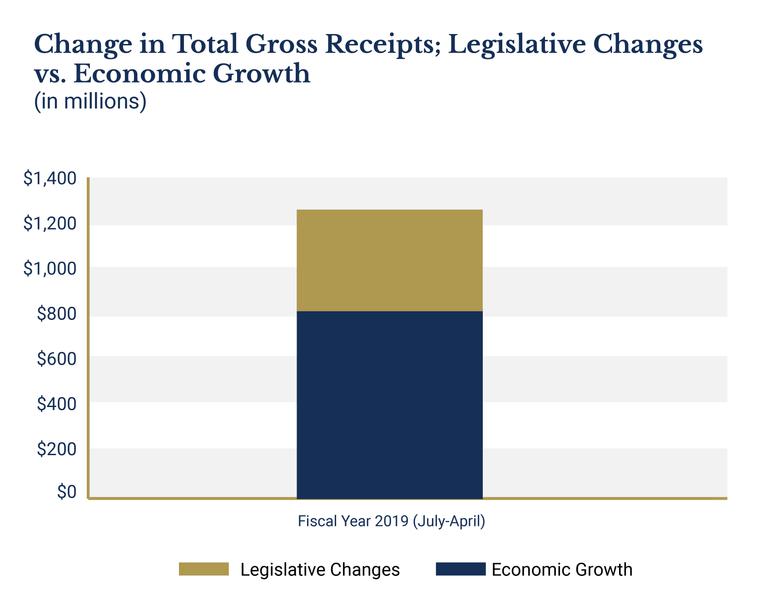

New revenue from House Bill 1010xx amounted to $47.2 million, or 27 percent, of the total growth for the month. The change in the gross production tax from 2 percent to 5 percent brought in the largest amount of new revenue at $26.3 million. The $1 increase in a pack of cigarettes brought in $13.3 million, while the six-cent increase in the diesel fuel tax brought in the smallest amount at $7.5 million. For the entire fiscal year legislative changes economic growth accounted for $816 million, or 63.7 percent of total revenue growth.

Sources: Office of the State Treasurer, monthly “Gross Receipts to the Treasury” reports; Office of Management and Enterprise Services, monthly General Revenue Fund allocation reportsa

Curtis Shelton

Policy Research Fellow

Curtis Shelton currently serves as a policy research fellow for OCPA with a focus on fiscal policy. Curtis graduated Oklahoma State University in 2016 with a Bachelors of Arts in Finance. Previously, he served as a summer intern at OCPA and spent time as a staff accountant for Sutherland Global Services.